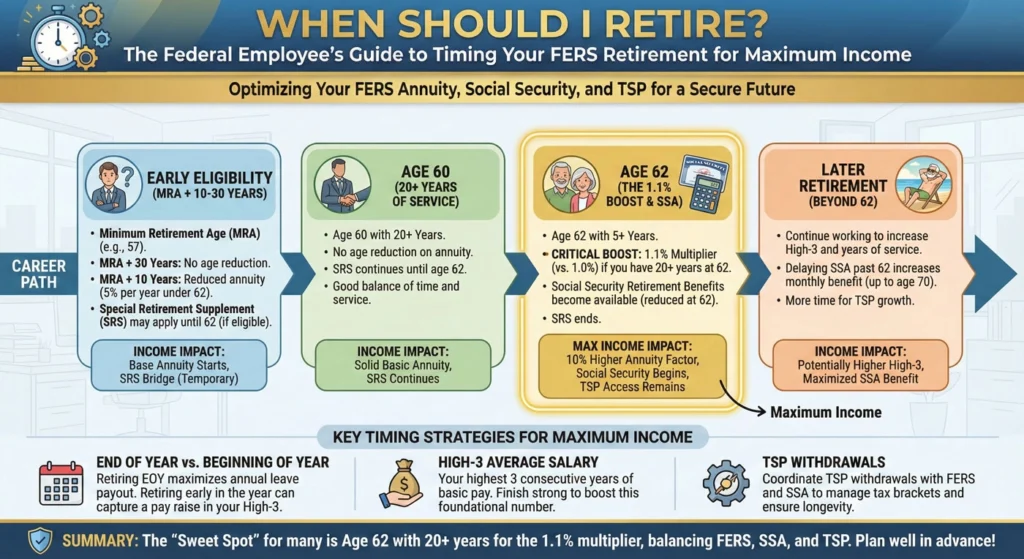

Look, I get it. Retirement planning sounds about as exciting as watching paint dry, right? But here’s the thing – if you’re a federal employee, your retirement situation is actually pretty unique (and honestly, pretty awesome if you play your cards right).

Unlike your friends working in the private sector who are basically gambling with their 401(k)s and hoping for the best, you’ve got this whole structured system working for you. But – and this is a big but – the timing of when you actually pull that retirement trigger can literally make or break your financial future. We’re talking about potentially hundreds of thousands of dollars over your lifetime. Yeah, you read that right.

So here’s what we’re dealing with: the Federal Employees Retirement System (FERS) has three main parts that work together – your pension (the Basic Benefit Plan), your Thrift Savings Plan (TSP), and good old Social Security. Think of them as a three-legged stool. Remove one leg, and things get wobbly real quick.

My goal here? I’m gonna break down all those confusing age milestones and show you where the money actually is. No boring government-speak, I promise. Just straight talk about when retiring makes the most financial sense for you.

- Getting Clear on What You're Actually Getting: Your Core Retirement Benefits

- The Early Bird Option: MRA+30 and Why Everyone Calls It the "Golden Ticket"

- The Sweet Spot: Age 62 and the Magic 10% Pension Boost

- The Not-So-Great Options: Early Retirement Trade-offs

- The Hidden Gold Mine: Sick Leave Conversion (This Could Be Worth Thousands!)

- Strategic Timing: When to Actually Pull the Trigger

- The 2025-2027 Optimal Retirement Dates

- Understanding Your First-Year COLA: Timing Is Everything

- Tax Bombs: The 40% Surprise on Your Final Leave Check

- Real-Life Example: Meet Shirley and Her Retirement Numbers

- Don't Forget the Other Stuff: Health Care, Insurance, and Administrative Details

- Bringing It All Together: Your Personal Retirement Roadmap

- Your Action Plan: What to Do Right Now

- The Bottom Line

Getting Clear on What You’re Actually Getting: Your Core Retirement Benefits

The FERS Pension – Let’s Do Some Math (Don’t Worry, It’s Easy!)

Okay, first things first. Your FERS pension is based on something called your “High-3” average salary. Basically, it’s the average of your highest-earning three consecutive years. For most folks, that’s gonna be your last three years before you retire, since you’re (hopefully!) making more money as you gain experience.

Here’s the catch though – we’re talking about your actual base salary here. Overtime? Nope. Bonuses? Nada. Just your regular paycheck amount. Your High-3 does include locality pay and certain special rates (like law enforcement pay), but retention bonuses, awards, and overtime are excluded. This matters because if you’re counting on that big overtime year to boost your pension, you’re gonna be disappointed.

Now, the formula itself is super straightforward:

Annual Pension = High-3 Average Salary × 1.0% × Years of Service

So if your High-3 is $100,000 and you’ve worked for 30 years, that’s $100,000 × 1% × 30 = $30,000 per year for the rest of your life. Not too shabby!

When Can You Actually Retire? The Age Game

This is where things get interesting. You can’t just wake up one Tuesday and decide you’re done. You need to hit certain age and service combinations to qualify for immediate retirement benefits.

First up is your Minimum Retirement Age, or MRA. Depending on when you were born, this ranges from 55 to 57. If you were born in 1970 or later, your MRA is 57. (Getting older every year, aren’t we?)

Here’s the full breakdown:

| Birth Year | Minimum Retirement Age (MRA) |

| Before 1948 | 55 |

| 1948 | 55 and 2 months |

| 1949 | 55 and 4 months |

| 1950 | 55 and 6 months |

| 1951 | 55 and 8 months |

| 1952 | 55 and 10 months |

| 1953-1964 | 56 |

| 1965 | 56 and 2 months |

| 1966 | 56 and 4 months |

| 1967 | 56 and 6 months |

| 1968 | 56 and 8 months |

| 1969 | 56 and 10 months |

| 1970 or later | 57 |

To retire with full, unreduced benefits right away, you need to meet one of these combos:

- Hit your MRA with 30 years of service (we call this MRA+30 – it’s kind of a big deal)

- Turn 60 with at least 20 years under your belt

- Make it to 62 with just 5 years of service

Each of these opens different doors, and honestly, choosing between them is where most people get confused.

The Early Bird Option: MRA+30 and Why Everyone Calls It the “Golden Ticket”

Retiring at MRA+30: Getting Out Early with Full Benefits

So here’s why federal employees get all excited about MRA+30 – it’s literally the earliest you can retire with immediate, full, unreduced benefits. If you started working for the government in your mid-20s, you could potentially be out the door in your mid-to-late 50s with a full pension. Your friends in the private sector? Still grinding away.

But wait, there’s more! (Sorry, I’ve been watching too many infomercials.)

The FERS Supplement: Your Secret Weapon Until Age 62

If you retire under MRA+30 (or at age 60 with 20 years), you get this amazing thing called the FERS annuity supplement. It’s basically a bridge payment that estimates what you would’ve gotten from Social Security if you could collect at 62, and it pays you from retirement until you actually turn 62.

The calculation looks something like this:

(Years of Federal Service / 40) × Your Estimated Social Security Benefit at Age 62

So if you worked 30 years for the feds and your Social Security estimate is $20,000, you’d get about $15,000 per year as a supplement. That’s an extra $1,250 a month! Not bad for a “supplement,” right?

Let me give you a real example. Meet Florence. She retired with 35 years of FERS service, and her Social Security statement estimated her age 62 benefit at $15,000 per year. Here’s how her supplement works out:

(35 years / 40) × $15,000 = $13,125 per year

Florence gets about $1,093 per month in supplement payments from the day she retires until she turns 62. Then it just stops – whether she’s claimed actual Social Security or not.

But Hold Up – The Supplement Has a Catch

Here’s where you need to pay attention, especially if you’re one of those energetic types planning a second career. The FERS supplement follows the Social Security earnings test rules. Translation? If you’re earning income from work after retiring (wages or self-employment), and it goes over the annual limit – which was $22,320 in 2024 – they start taking your supplement away. For every $2 you earn over that limit, they reduce your supplement by $1.

So if you’re planning to retire at 57 and then immediately start a consulting gig making $60,000 a year, let’s do the math: $60,000 – $22,320 = $37,680 over the limit. Divide that by 2, and you lose $18,840 of your supplement. If your total supplement was only $13,125 (like Florence’s), congratulations – you just zeroed it out completely. Something to think about!

Legislative Drama: The Supplement Might Not Be Around Forever

Okay, this is important and honestly kind of scary. Congress has been kicking around proposals to eliminate the FERS supplement for most people who retire before 62. Right now, the proposed effective date is January 1, 2028. If you’re in law enforcement, firefighting, or another position with mandatory early retirement, you’d likely be protected. But for everyone else? This could be a game-changer.

If you’re close to retirement and counting on that supplement, you might want to keep a close eye on this legislation. Using a federal retirement calculator now to see how losing the supplement would affect your plans is probably a smart move.

The Sweet Spot: Age 62 and the Magic 10% Pension Boost

Why Age 62 Might Be Your Real Golden Ticket

Alright, here’s where things get really interesting from a dollars-and-cents perspective. If you wait until you’re 62 to retire AND you have at least 20 years of service, that pension multiplier we talked about earlier jumps from 1.0% to 1.1%.

“Wait,” you’re thinking, “that’s only 0.1%. Big deal.”

Oh, but it IS a big deal! That tiny-looking increase actually boosts your entire pension by 10%. And remember, this is money you get every single month for the rest of your life.

Let’s run the numbers: Say you’ve got that same $100,000 High-3 with 20 years of service.

| Scenario | Formula | Annual Annuity |

| Retiring at 61 with 20 years | $100,000 × 20 × 1.0% | $20,000 |

| Retiring at 62 with 20 years | $100,000 × 20 × 1.1% | $22,000 |

That’s an extra $2,000 every single year. Plus, when cost-of-living adjustments (COLAs) kick in, they’re being calculated on that higher base amount, so the difference compounds over time.

Over a 30-year retirement, we’re talking about tens of thousands of extra dollars. Maybe even over $100,000 when you factor in those COLAs. Suddenly that 0.1% doesn’t seem so small anymore, does it?

Other Good Stuff That Happens at 62

Age 62 is kind of like unlocking a new level in a video game. Suddenly, a bunch of things become available:

Social Security kicks in: You can start drawing Social Security benefits at 62, though they’ll be reduced compared to waiting until your full retirement age (usually 67 these days). Whether you should actually take it at 62 is a whole other conversation involving actuarial tables and life expectancy predictions. Fun times!

TSP flexibility: If you separate from federal service in the year you turn 55 or later, you can generally pull money from your TSP without that annoying 10% early withdrawal penalty. This gives you a lot more flexibility in managing your retirement income.

The trade-off: Here’s the kicker though – you can’t have your cake and eat it too. You can either get the FERS supplement (MRA+30, ends at 62) or the 1.1% multiplier boost (age 62+), but not both. They’re mutually exclusive, like choosing between two paths in those old Choose Your Own Adventure books.

A Helpful Way to Think About It

I like to think of the federal retirement system like a multi-stage rocket (bear with me here).

Stage 1 (MRA+30) gets you off the ground quickly. You’re out the door earlier with immediate, unreduced benefits, plus that nice FERS supplement booster rocket helping you along until 62. Great if you’re ready to be done working or have other plans for your time.

Stage 2 (Age 62+20) is more like upgrading your engine permanently. You’re not leaving as early, but once you do, you’ve got maximum thrust for the rest of your journey. That 1.1% multiplier is a structural upgrade that pays dividends for your entire retirement.

Which stage is right for you? That depends on your health, your financial needs, how much you hate (or actually like) your job, and what you want to do with your life. Using a federal retirement calculator can help you model both scenarios with your actual numbers.

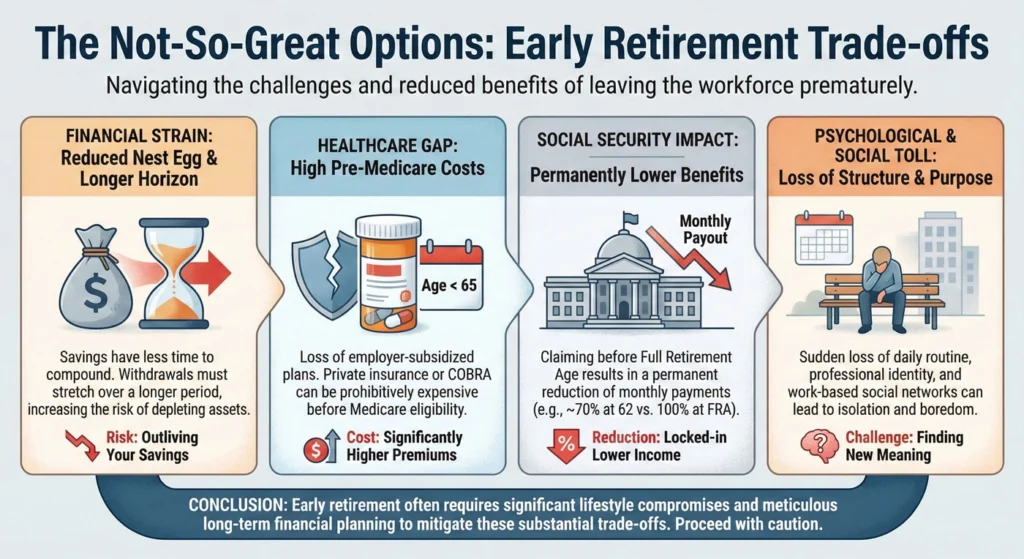

The Not-So-Great Options: Early Retirement Trade-offs

The MRA+10 Penalty: Ouch

Look, life happens. Maybe you’ve got 15 years in and you just can’t do it anymore. There is an option to retire at your MRA with only 10-29 years of service. It’s called MRA+10.

But here’s the brutal truth: this option comes with a permanent 5% reduction for every year you are under age 62. Did I mention permanent? Because it’s permanent.

Let’s say you retire at MRA (age 57) with 15 years of service. You’re five years short of 62, so that’s a 25% permanent cut to your annuity. For the rest of your life. If your pension would’ve been $15,000 per year, you’re now looking at $11,250. Every. Single. Year.

Now, there’s a nuance here that matters. If you hit age 60 with exactly 20 years of service, you avoid this penalty entirely. But if you’re at age 60 with only 19 years? You’d face a 10% permanent reduction if you start your annuity immediately. One year of service makes a massive difference!

Honestly? Unless you’re in dire health or have a compelling reason, this option is usually pretty painful financially.

Deferred and Postponed Retirement: The Waiting Game

Sometimes you leave federal service before you’re eligible to collect benefits. Maybe you got a job offer you couldn’t refuse, or life circumstances changed. You’ve still got options, just with some waiting involved.

Deferred retirement means you leave before meeting the age and service requirements, but you can still collect later. For example, if you leave at 55 with 8 years of service, you can start collecting a pension at 62 (since you’ll have at least 5 years).

Postponed retirement is when you’re eligible for reduced benefits (like MRA+10) but you choose to wait to apply. Each year you wait reduces or eliminates that age penalty. Smart play if you’ve got 10+ years but aren’t quite at 30 yet.

Special Circumstances: Involuntary Separations and Disability

Sometimes the decision to leave isn’t really yours. If there are layoffs or the government offers Voluntary Early Retirement Authority (VERA), you might qualify for early retirement benefits at age 50 with 20 years or any age with 25 years. These are actually pretty decent deals if you’re affected – there’s no permanent reduction penalty like with MRA+10.

Disability retirement is available if you become unable to perform your job, but it comes with its own set of rules and, unfortunately, you typically won’t get the FERS supplement.

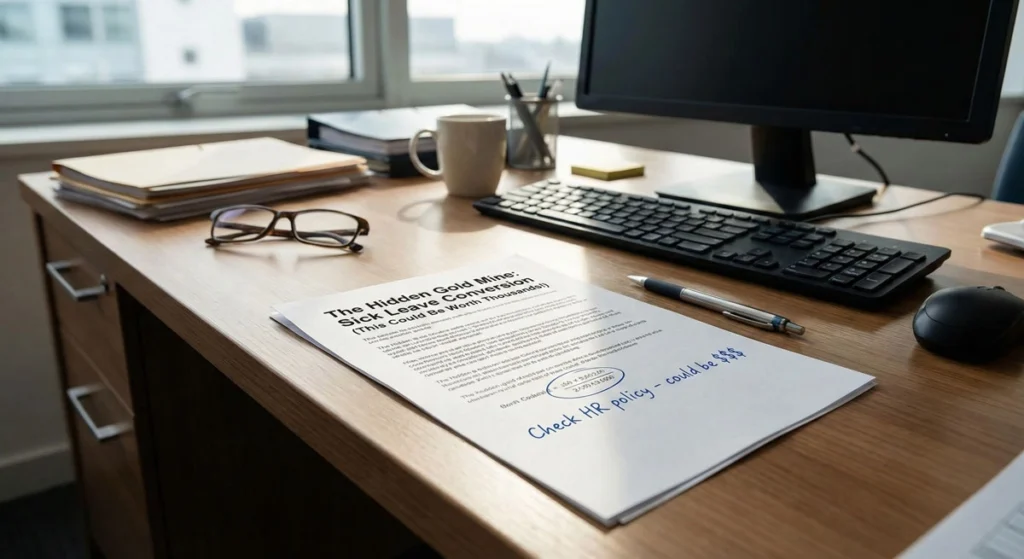

The Hidden Gold Mine: Sick Leave Conversion (This Could Be Worth Thousands!)

Okay, this is one of those things that nobody tells you about until it’s too late. Your unused sick leave? It’s actually worth real money in your pension calculation – but only if you understand how the math works.

How Sick Leave Converts to Pension Credit

Since January 1, 2014, FERS employees get credit for 100% of their unused sick leave. OPM converts your sick leave hours into additional years and months of service, which then pumps up your pension calculation. But here’s the catch – and this is huge – it only increases your annuity amount. It doesn’t count toward meeting eligibility requirements.

The government uses a 2,087-hour work year for the conversion:

| Unused Sick Leave Hours | Service Credit Equivalent |

|---|---|

| 174 Hours | 1 Month |

| 1,044 Hours | 6 Months |

| 2,087 Hours | 1 Year |

The “Dropped Days” Problem That Can Cost You Money

Here’s where it gets tricky. OPM only counts full years and full months (30 days) in your final pension calculation. Any leftover days that don’t add up to a full month? They get dropped and you get nothing for them.

Let me tell you about Athena, because her situation is a perfect example of how 15 days can cost you real money.

Athena’s Story:

Athena is planning to retire on December 31, 2025. Based on her entry date, her actual creditable service is 27 years, 7 months, and 17 days. She’s got 857 hours of unused sick leave banked.

Using the 2087-hour conversion chart, her 857 hours (which rounds up to 858) converts to 4 months and 28 days of additional service.

| Component | Years | Months | Days |

|---|---|---|---|

| Actual Service | 27 | 7 | 17 |

| Sick Leave Credit | 0 | 4 | 28 |

| Combined Total | 28 | 0 | 15 |

See what happened there? Those 15 days just disappear. OPM drops them because they don’t make a full month. Athena worked 27+ years and has almost a month of extra service sitting there – but she gets credit for exactly 28 years and 0 months.

The Fix:

If Athena works just 15 more days (or accrues about 87 more hours of sick leave), she’d hit 28 years and 1 month. That extra month of pension? She gets it for the rest of her life. If her High-3 is $100,000, that one month is worth about 83 per year (\100,000 × 1% ÷ 12). Not huge by itself, but multiply that by 30 years of retirement and you’re looking at $2,500. Plus COLAs on top of that.

The lesson? Check your sick leave balance when you’re doing retirement planning. Those “dropped days” could be costing you more than you think.

Strategic Timing: When to Actually Pull the Trigger

Okay, so you’ve got your age and service figured out. But the specific DATE you retire? That matters way more than you’d think. We’re talking about potentially tens of thousands of dollars in difference based on whether you retire on the 15th versus the 31st of a month.

The Annuity Commencement Gap (And How to Avoid It)

Here’s a rule that trips people up all the time: Your FERS annuity begins on the first day of the month AFTER the month you separate. Not the day after you retire. The month after.

Let’s see what that means in practice:

- Retire May 1: Annuity begins June 1. You’ve got a 30-day gap with no income.

- Retire May 31: Annuity begins June 1. You’ve got a 1-day gap.

By retiring on the last day of the month, you get your full salary for that month, and your pension kicks in immediately after. If you retire early in the month, you’re burning through savings or leave balances for no good reason.

Pay Period Timing: Don’t Leave Money on the Table

Federal employees accrue leave on a biweekly pay period basis. You earn your annual leave and sick leave when the pay period ENDS, not when you retire. If you retire on the Friday before a pay period ends on Saturday, you just gave away 4-8 hours of annual leave and 4 hours of sick leave for those two weeks. At a GS-14 or GS-15 salary level, that’s real money.

The absolute best retirement dates are when the end of a pay period lines up with the end of a month. You capture your final leave earnings and start your pension without a gap.

The Annual Leave Jackpot: End-of-Leave-Year Strategy

Annual leave is the only part of your federal benefits that turns into straight cash when you retire. You get a lump sum payment based on your final hourly rate for every hour of unused annual leave. And here’s the beautiful part – there’s no cap when you retire.

During your normal working years, you can only carry over 240 hours of annual leave into the new year. Anything above that is “use-or-lose.” But if you retire before the leave year ends, you get paid for your entire accumulated balance, no matter how high.

Here’s the strategy: Carry your maximum 240 hours into your final leave year. Accrue another 208 hours throughout the year (8 hours per pay period for 26 pay periods). By the end of the leave year, you’ve got 448 hours. If you’re a high-level GS-15 making about $85/hour, that lump sum is over $38,000!

But here’s where it gets even better: If a federal pay raise takes effect in January and you retire early that month (before the leave year ends), your lump sum payment is “projected forward” at the new, higher salary rate. Any leave that would have been “used” during those January pay periods gets calculated at the increased rate.

This makes early January – right after the pay raise but before the leave year ends – potentially the most lucrative retirement date for maximizing your annual leave payout.

The 2025-2027 Optimal Retirement Dates

Based on how the calendars line up with pay periods and leave years, here are the absolute best dates to retire over the next few years:

Optimal Dates for 2025:

- January 10, 2025: End of the 2024 leave year. Perfect for cashing out maximum annual leave at 2025 pay rates.

- May 31, 2025: Saturday end-of-pay-period and end-of-month. Captures final May accrual, minimizes income gap.

- December 31, 2025: Wednesday end-of-month. Great for tax year considerations.

Optimal Dates for 2026:

- January 10, 2026: Saturday end-of-pay-period AND end-of-leave-year. This is considered an “All-Star” date for leave maximization.

- May 31, 2026: Sunday end-of-pay-period and end-of-month. Pension begins June 1 with zero gap.

- October 31, 2026: Saturday end-of-pay-period and end-of-month. Pension begins November 1.

Optimal Dates for 2027:

- January 9, 2027: The ultimate combo. End of leave year, ensuring all 2026 accruals get paid at 2027 salary rates.

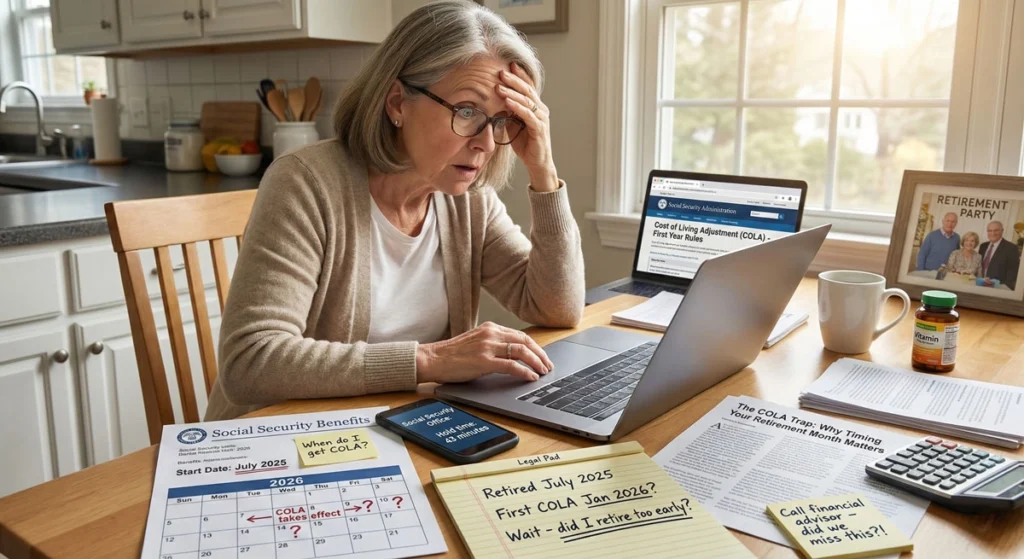

Understanding Your First-Year COLA: Timing Is Everything

Cost-of-Living Adjustments (COLAs) are supposed to protect you from inflation eating away at your purchasing power. But unlike CSRS retirees who get COLAs immediately, FERS retirees generally have to wait until age 62 to start getting them.

The FERS “Diet COLA” Formula

Even when you do qualify, FERS uses what people call a “Diet COLA” that’s usually less than the actual inflation rate:

| CPI-W Increase | FERS COLA Amount |

|---|---|

| Less than 2% | Full CPI-W Increase |

| 2% to 3% | 2.0% Flat |

| Greater than 3% | CPI-W Increase minus 1.0% |

The Proration Trap

Here’s something most people don’t realize: Your first COLA gets prorated based on how many months you’ve been retired. The COLA typically happens in January. To get the FULL COLA increase, you need to have retired by December 31 of the previous year.

If you retire on June 30, you’ve only been on the annuity rolls for six months when the January COLA hits. So you only get 6/12 (or 50%) of that year’s COLA. If the COLA is 3.0%, you’d only get 1.5%.

This is yet another reason why December 31 retirement dates are so popular – you maximize your very first inflation adjustment.

Tax Bombs: The 40% Surprise on Your Final Leave Check

Let’s talk about something that shocks the hell out of people – the taxes on that annual leave lump sum.

You’re expecting a big fat check for all those years of saved-up leave. And you DO get it. But then you see the taxes withheld and nearly have a heart attack. We’re talking federal income tax, state income tax (if applicable), Social Security (FICA), and Medicare. For high earners, the total bite can exceed 40%.

The FICA Tax Reset Strategy

Here’s a little-known strategy for high earners. In 2024, Social Security (FICA) taxes of 6.2% only apply to the first $168,600 of earnings. Once you hit that cap (usually around November if you make $200,000+), you stop paying the 6.2% on your regular paychecks.

Now watch what happens:

Retire November 30: Your lump-sum leave check is paid in the same tax year. Since you already hit the Social Security wage cap, NO 6.2% FICA tax is withheld from your leave payout. You just saved over $2,000 on a $38,000 leave check!

Retire December 31: Your lump-sum leave check is paid in January of the next year. The FICA clock resets for the new tax year, and the 6.2% gets withheld until you hit the cap again (which you probably won’t in retirement). You just lost that $2,000+.

However – and this is important – you need to balance this against your overall tax bracket. If you’re moving into a lower tax bracket in retirement (say, dropping from 24% to 12%), the 12% federal tax savings might outweigh the 6.2% FICA cost. It depends on your specific numbers.

Real-Life Example: Meet Shirley and Her Retirement Numbers

Let me show you a real case study of how all this works in practice. Meet Shirley, a long-term federal employee who represents what many of you can expect.

Shirley While Working (Monthly Breakdown)

Gross Monthly Salary: $8,413.60

| Deduction | Monthly Amount |

|---|---|

| FERS Contribution | $67.32 |

| Medicare/Social Security | $611.07 |

| Health/Life/Dental/Vision | $532.55 |

| Federal/State Income Tax | $1,166.36 |

| TSP Contribution (15%) | $1,716.00 |

| Net Take-Home Pay | $4,320.30 |

Shirley in Retirement (Monthly Breakdown)

After retiring at age 62 with 20 years of service and a High-3 of $101,312:

| Income Source | Gross Amount | Deductions | Net Amount |

|---|---|---|---|

| FERS Basic Benefit | $1,857.38 | $903.19 | $954.19 |

| Social Security | $1,676.00 | $280.00 | $1,396.00 |

| TSP Withdrawal | $2,836.88 | $709.22 | $2,127.66 |

| Total | $6,370.26 | $1,892.41 | $4,477.85 |

Notice something amazing? Shirley’s retirement net income (4,477.85) actually EXCEEDS her working take-home pay (\4,320.30).

How is that possible? Two big reasons:

- She’s no longer contributing 15% to her TSP ($1,716/month saved)

- She’s no longer paying Social Security taxes on most of her income

But here’s the critical part: Shirley hit that age 62 milestone with 20 years of service, so she got the 1.1% multiplier. If she’d retired even one month earlier, her FERS benefit would’ve been about $185 less per month. Over 30 years, that early retirement would’ve cost her close to $100,000 in lifetime pension income.

Her success wasn’t luck – it was precise timing.

Don’t Forget the Other Stuff: Health Care, Insurance, and Administrative Details

The FEHB 5-Year Rule: Don’t Mess This Up

Here’s something that can really bite you if you’re not careful. To keep your Federal Employee Health Benefits (FEHB) coverage into retirement – and trust me, you want this – you must have been enrolled for the five years immediately before retirement.

If you switched to your spouse’s insurance three years ago to save money? Congrats, you just disqualified yourself from federal health benefits in retirement. Oops.

Also, heads up: in retirement, you’re paying FEHB premiums with after-tax dollars, which means they’ll feel more expensive than when the government was chipping in and taking it from your pre-tax paycheck.

At 65, you’ll need to enroll in Medicare (Part A is usually free for federal retirees). Understanding how Medicare coordinates with your FEHB plan is important, but that’s honestly complicated enough for its own blog post.

FEGLI: To Keep or Not to Keep?

Federal Employee Group Life Insurance (FEGLI) is great while you’re working, but those premiums can absolutely skyrocket around age 55. I’m talking “did they add an extra zero by mistake?” levels of expensive.

You’ll need to decide whether to continue coverage, reduce it, or drop it entirely and maybe find a more affordable private option. This is definitely one of those areas where talking to a financial advisor who specializes in federal benefits can save you serious money.

Strategic Leave Management

Sick leave: This is actually really valuable! As we discussed earlier with Athena’s example, any unused sick leave hours get converted into creditable service time that counts toward your pension. If you’re sitting at 19 years and 8 months of service with a bunch of sick leave banked, that could push you over the 20-year threshold needed for the 1.1% multiplier at age 62.

Annual leave: Gets paid out as a lump sum when you retire. Nice little retirement bonus, though it’s all taxable in that year. And as we covered, timing this payout strategically can maximize the amount you receive.

Military buyback: If you served in the military before your federal civilian career, you can “buy back” that time by making a deposit. This adds those years to your creditable service, pumping up your pension. Often a very good deal if you’ve got military time.

The OPM Processing Reality Check

When you finally submit your retirement application to the Office of Personnel Management (OPM), don’t expect immediate gratification. As of September 2025, the average processing time from receipt to final adjudication was about 76 days. That’s two and a half months!

Make sure your finances can handle that gap, because you’ll be in what they call “interim pay” until OPM finishes processing everything. It’s usually less than your final annuity will be, so budget accordingly.

Bringing It All Together: Your Personal Retirement Roadmap

Look, I’ve thrown a lot of information at you, and your eyes might be glazing over at this point. But here’s the bottom line: there’s no magic age that works for everyone. Your best retirement age depends on your personal situation – your financial needs, your health, whether you love or hate your job, what you want to do in retirement, and dozens of other factors.

That said, from a pure financial optimization standpoint, the two big sweet spots in the federal retirement system are:

MRA+30: Get out the earliest with full benefits plus the FERS supplement bridge payment (at least until Congress potentially eliminates it).

Age 62+20: Lock in that permanent 10% pension boost from the 1.1% multiplier that lasts your entire retirement.

Everything else is basically a trade-off between these positions.

The research shows that federal employees who treat their retirement date selection with the same precision as their investment strategy are significantly more likely to achieve a retirement income that meets or exceeds their working income. Even something as small as 15 days of service can result in losing a full month of pension credit for life. When you’re talking about 25-30 years of retirement, those “small” details compound into massive financial differences.

Your Action Plan: What to Do Right Now

Alright, enough theory. Let’s talk about what you should actually DO with all this information:

1. Crunch the numbers: Find a good federal retirement calculator and plug in your actual information. Model different scenarios – retiring at MRA+30 versus waiting until 62. See the real dollar differences with YOUR numbers, not the examples I’ve been using. The results might surprise you.

2. Check your sick leave balance: Log into your HR system right now and see how many hours you have. Run the conversion math. Are you close to earning another month of service credit? Maybe banking some sick leave instead of using it is worth it.

3. Map out your optimal retirement dates: Look at those calendar sweet spots for 2025-2027. Which dates align with your eligibility and maximize your annual leave payout? Circle them on your calendar.

4. Check your insurance situation: Right now, today, verify you meet that FEHB 5-year enrollment rule. If you don’t, fix it immediately. Future you will thank present you.

5. Maximize your High-3: If you’re within a few years of retirement, think strategically about how to maximize your salary in those final three years. Promotions, step increases, and locality adjustments all matter because they directly affect your pension calculation.

6. Get professional help: This is complicated stuff, and one mistake can cost you tens of thousands of dollars. Consider hiring a financial advisor who specializes in federal benefits – look for someone with a ChFEBC (Chartered Federal Employee Benefits Consultant) or CFP (Certified Financial Planner) designation who works with federal employees regularly. They can help you coordinate your pension, TSP, Social Security, and health benefits into an actual plan rather than just hoping it all works out.

7. Stay informed: Keep an eye on that legislation about eliminating the FERS supplement. If you’re counting on it and it goes away, that could change your entire retirement timeline.

The Bottom Line

Federal retirement is genuinely one of the better retirement systems out there, but it’s also complex enough that you can make expensive mistakes if you don’t understand how the pieces fit together. The difference between retiring at the right time versus the wrong time can literally be worth six figures over your lifetime.

The data is clear: the intersection of your age, your years of service, your peak earning period, and your actual separation date creates thousands of different outcome scenarios. Some will leave you financially comfortable for life. Others will leave you wondering why you’re struggling despite working 30 years for the government.

Success in the FERS system isn’t about luck – it’s about calculation. It’s about understanding that 15 days of service can mean losing a month of pension forever. It’s about knowing that retiring at 61 and 11 months versus 62 costs you 10% of your pension for life. It’s about recognizing that the difference between retiring on December 15 versus January 10 could be 5,000-\10,000 in your annual leave check.

So take the time to understand your options. Use that federal retirement calculator to model different scenarios. Talk to people who’ve already retired. And seriously consider getting professional advice – it’s one of those situations where spending a little money now can save you a lot of money later.

Your future retired self is counting on present-day you to make smart decisions. Don’t let them down!

And hey, if all this seems overwhelming, just remember: millions of federal employees have figured this out before you, and millions more will after you. You’ve got this. Just take it one step at a time, use the resources available to you, and make the choice that’s right for YOUR life, not what worked for someone else.

Now go use that federal retirement calculator and start actually planning instead of just worrying. You’ll feel better once you have real numbers to work with!

References:

Office of Personnel Management (OPM) Publications:

U.S. Office of Personnel Management. (2024). FERS Information: Retirement Benefits for New Employees. Retrieved from https://www.opm.gov/retirement-services/fers-information/

U.S. Office of Personnel Management. (2024). CSRS and FERS Handbook for Personnel and Payroll Offices. Chapter 50: FERS Annuities. Washington, DC: U.S. Government Publishing Office.

U.S. Office of Personnel Management. (2024). Federal Employees Retirement System: An Overview of Your Benefits. RI 90-1. Washington, DC.

U.S. Office of Personnel Management. (2024). The Special Retirement Supplement and Social Security. RI 84-5. Washington, DC.

U.S. Office of Personnel Management. (2024). Computation of Basic Annuity for FERS Employees. RI 83-11. Washington, DC.

U.S. Office of Personnel Management. (2025). Monthly Retirement Processing Update – September 2025. Retrieved from https://www.opm.gov/retirement-services/retirement-statistics/

Federal Statutes and Regulations:

- 5 U.S.C. Chapter 84 – Federal Employees’ Retirement System. United States Code.

- 5 CFR Part 842 – Federal Employees Retirement System: Basic Annuity. Code of Federal Regulations.

- 5 CFR § 842.402 – Minimum retirement age (MRA). Code of Federal Regulations.

- 5 CFR § 842.403 – Eligibility for immediate retirement. Code of Federal Regulations.

- 5 CFR § 842.405 – Computation of basic annuity. Code of Federal Regulations.

Social Security Administration:

Social Security Administration. (2024). Retirement Earnings Test Limits for 2024. Publication No. 05-10069. Baltimore, MD.

Social Security Administration. (2024). How Work Affects Your Benefits. Publication No. 05-10069. Retrieved from https://www.ssa.gov/benefits/retirement/planner/whileworking.html

Internal Revenue Service:

Internal Revenue Service. (2024). Publication 721: Tax Guide to U.S. Civil Service Retirement Benefits. Washington, DC: Department of the Treasury.

Internal Revenue Service. (2024). 2024 Social Security Wage Base Limit. Notice 2023-75. Retrieved from https://www.irs.gov/

Legislative References:

H.R. 82 – Social Security Fairness Act of 2023. 118th Congress (2023-2024).

Proposed FERS Special Retirement Supplement Elimination Act. Congressional Bill Analysis (Pending as of 2024-2025 legislative session).

Technical Documentation

U.S. Office of Personnel Management. (2024). FERS Sick Leave Credit Information. CSRS/FERS Handbook, Chapter 50, Subchapter S50A5.

U.S. Office of Personnel Management. (2024). Leave Administration: Annual Leave and Lump-Sum Payments. OPM Benefits Administration Letter 24-201.

U.S. Office of Personnel Management. (2024). Federal Employees Health Benefits (FEHB) Handbook. Retrieved from https://www.opm.gov/healthcare-insurance/healthcare/

U.S. Office of Personnel Management. (2024). Federal Employees’ Group Life Insurance (FEGLI) Program. RI 76-21. Washington, DC.

Cost of Living Adjustment (COLA) Sources

U.S. Office of Personnel Management. (2024). FERS Cost-of-Living Adjustments. Retrieved from https://www.opm.gov/retirement-services/publications-forms/csrsfers-handbook/c2144.pdf

Bureau of Labor Statistics. (2024). Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). U.S. Department of Labor. Retrieved from https://www.bls.gov/cpi/

Thrift Savings Plan References

Federal Retirement Thrift Investment Board. (2024). TSP Withdrawal Rules and Options. Retrieved from https://www.tsp.gov/living-in-retirement/

Federal Retirement Thrift Investment Board. (2024). TSP Early Withdrawal Penalties and Exceptions. Publication TSP-775.

Military Service Credit

U.S. Office of Personnel Management. (2024). Military Service Credit: FERS Deposit Information. RI 84-2. Washington, DC.

Pay Period and Leave Year Calendars

U.S. Office of Personnel Management. (2024). 2025 Leave Year Calendar. Retrieved from https://www.opm.gov/policy-data-oversight/pay-leave/leave-administration/fact-sheets/leave-year-beginning-and-ending-dates/

U.S. Office of Personnel Management. (2024). 2025 Pay Period Calendar. Retrieved from https://www.opm.gov/policy-data-oversight/pay-leave/pay-administration/fact-sheets/official-2025-federal-pay-period-calendar/

U.S. Office of Personnel Management. (2026). 2026 Leave Year Calendar. Retrieved from https://www.opm.gov/policy-data-oversight/pay-leave/leave-administration/fact-sheets/leave-year-beginning-and-ending-dates/

U.S. Office of Personnel Management. (2027). 2027 Pay Period Calendar. Retrieved from https://www.opm.gov/policy-data-oversight/pay-leave/pay-administration/

Actuarial and Statistical Resources

Congressional Research Service. (2024). Federal Employees’ Retirement System: Benefits and Financing. Report R43445. Washington, DC: Library of Congress.

U.S. Government Accountability Office. (2023). Federal Retirement: Analysis of FERS Benefits and Timing Considerations. GAO-23-105291. Washington, DC.

Professional Certification Bodies

American College of Financial Services. (2024). Chartered Federal Employee Benefits Consultant (ChFEBC) Program Curriculum. Bryn Mawr, PA.

Certified Financial Planner Board of Standards. (2024). CFP Certification Requirements and Standards of Professional Conduct. Washington, DC.