Okay, so picture this: You’re sitting down to do your taxes, maybe you’re expecting a nice little refund to treat yourself, and then—BAM. You owe the IRS twenty grand. Or maybe it’s ten grand. Or thirty. Whatever the number, it’s way more than you’ve got sitting in your checking account right now.

Deep breath. I know that sinking feeling is real, but here’s the good news: You’ve actually got options. And no, I’m not talking about fleeing the country or changing your identity (please don’t do that).

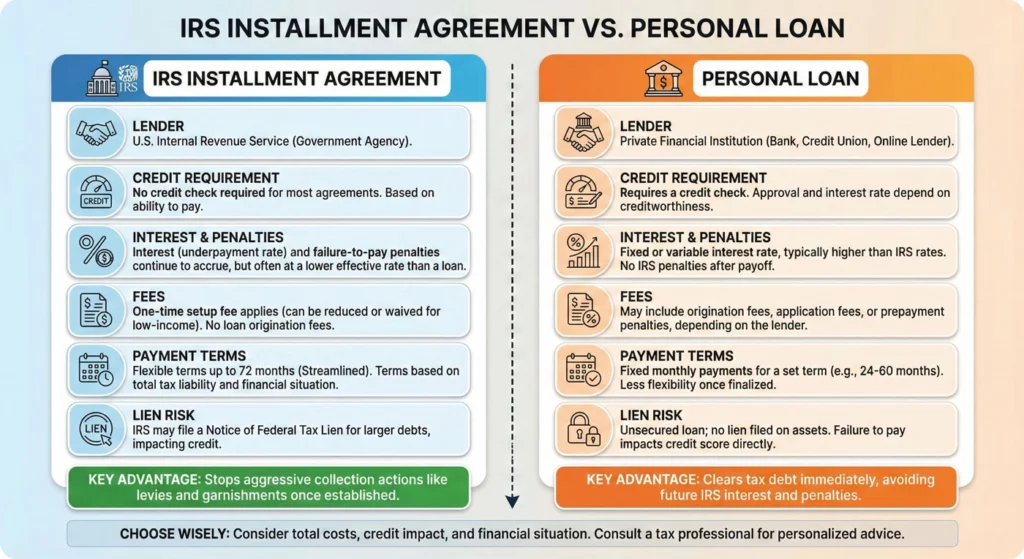

The two main routes most people consider when they need to pay tax debt are setting up an IRS Installment Agreement (basically a payment plan directly with the IRS) or taking out a personal loan to pay everything off in one shot. Both can work, but here’s the thing—one is usually gonna save you a whole lot more money than the other.

Here’s my take after digging through all the numbers: For most regular folks like you and me, the IRS Installment Agreement is typically the more cost-effective choice because the interest rates are generally lower. But—and this is a big but—it really depends on your personal credit profile.

In this post, I’m gonna walk you through both options, show you some real numbers using actual case studies (including that $20,000 tax bill example), and help you figure out which path makes the most sense for your wallet. And hey, if neither option works for you, I’ve got some backup plans too.

Let’s dive in!

- Understanding the IRS Installment Agreement (IA)

- Paying Taxes with a Personal Loan

- The Definitive Cost Comparison: Real Case Studies from 2026

- How Recent Tax Law Changes Affect Your Decision (2026 Update)

- Credit Score Impact: The Hidden Advantage of IRS Plans

- The 10-Year Collection Window (Something Most People Don't Know)

- Essential Alternatives to an Installment Agreement

- Step-by-Step: Setting Up Your IRS Payment Plan (Application Process)

- Strategic Decision Framework: Which Option Is Right for You?

- Choose the IRS Installment Agreement if:

- Choose a Personal Loan if:

- Frequently Asked Questions

- What is the minimum payment the IRS will accept?

- Will the penalty and interest accumulate on a long-term payment plan?

- How long is the 72-month payment plan?

- What happens if I default on my IRS installment agreement?

- Conclusion: Take Action Now, Thank Yourself Later

Understanding the IRS Installment Agreement (IA)

What an Installment Agreement Is and How It Works

Alright, so what exactly is an IRS Installment Agreement? Think of it like setting up a payment plan for anything else you might buy—except in this case, you’re buying your way out of tax debt.

Basically, it’s a formal arrangement where the IRS says, “Okay, we get it. You can’t pay this all at once. Let’s break it into monthly payments that won’t completely destroy your budget.” You agree to pay a certain amount each month over a specific period, and in return, the IRS chills out and doesn’t come after your paycheck or bank account.

Here’s the deal though: This isn’t a get-out-of-jail-free card. The IRS Installment Agreement helps you avoid the really scary stuff like wage garnishments, bank levies, or tax liens showing up on your credit report. But you’ve gotta play by their rules.

The biggest rule? You need to have filed all your required tax returns before they’ll even consider setting you up with a payment plan. So if you’ve been avoiding filing because you know you owe money, you gotta rip that Band-Aid off first.

Four Key Types of IRS Payment Plans (Structured List/Schema Data)

Not all payment plans are created equal. The IRS actually offers four different types, and which one you can use depends on how much you owe and how long you need to pay it back. Let me break it down for you:

| Plan Type | Max Debt Threshold (Individuals) | Max Duration | Key Feature/Application |

|---|---|---|---|

| Short-Term Payment Plan | Less than $100,000 | 180 days or less | No setup fee, which is nice! But interest and penalties keep stacking up until you’re done paying. |

| Long-Term Installment Agreement | Less than $50,000 | Up to 72 months (6 years) | Good for bigger debts; there’s a setup fee but you get way more time to pay. |

| Streamlined Installment Agreement | Less than $50,000 | Up to 72 months | Super simplified application—usually don’t need to share all your financial details. |

| Partial Payment IA (PPIA) | No fixed maximum (based on what you can actually afford) | Typically up to 10 years | Here’s the wild part: whatever’s left after the collection period might actually be forgiven! But you gotta show them everything—your income, expenses, the works (Form 433-A/B/F). |

The Short-Term Payment Plan is perfect if you can swing it in six months or less and want to avoid any setup fees. But most people end up going with the Long-Term or Streamlined options because, let’s be real, paying off thousands of dollars in six months isn’t realistic for most of us.

IA Pros and Cons: Interest, Penalties, and Enforcement

Like anything in life, an IRS Installment Agreement has its ups and downs. Let’s talk about both so you know what you’re getting into.

The Good Stuff (Pros):

Stops Aggressive Collection Actions: This is huge. Once your payment plan is approved, the IRS can’t start garnishing your wages, draining your bank account, or seizing your property. They basically promise to leave you alone as long as you’re holding up your end of the deal.

Reduced Penalty Rate: Normally, if you’re late paying your taxes, the IRS hits you with a 0.5% penalty every month. But when you’re on an active installment agreement and making your payments on time, that penalty drops to just 0.25% per month. It’s not nothing, but every little bit helps.

Invisible to Credit Bureaus: Here’s something most people don’t know: As long as you’re complying with your payment plan, it doesn’t show up on your credit report. It won’t affect your credit score or your ability to get other loans. The IRS doesn’t report this stuff to Equifax, Experian, or TransUnion.

Flexible Payment: Your monthly payments are usually based on what you can actually afford to pay. The IRS isn’t trying to starve you here—they want their money, but they also know you need to, you know, live.

No Prepayment Penalty: If you suddenly come into some money (inheritance, bonus, lottery win—hey, I can dream), you can pay off the whole thing early without any penalty. This actually saves you money on interest, so it’s a win-win.

The Not-So-Good Stuff (Cons):

Interest Accrues Daily: Yeah, you read that right. Every single day you owe money, interest is piling up on that unpaid balance. It’s like a credit card that never sleeps. The IRS uses a daily compounding formula, which means you’re paying interest on your interest.

Current Interest Rate: As of Q1 2026, individuals are looking at a 7% annual interest rate, compounded daily. That’s the federal short-term rate (currently 4%) plus a statutory 3-percentage-point premium. While this sounds reasonable, when you add in daily compounding and penalties, your effective cost creeps closer to 10%.

Setup Fees: If you’re doing a long-term plan, there are setup fees. The cheapest option is $22 if you apply online and set up direct debit (automatic payments from your checking account). But if you apply by phone, mail, or in person and don’t do direct debit, you could pay up to $178. Ouch. The good news is that low-income taxpayers (those at or below 250% of the federal poverty level) might qualify for a fee waiver or complete reimbursement.

Risk of Default: Here’s where you gotta be careful. If you miss payments or fail to file your tax returns in future years, the IRS can terminate your agreement faster than you can say “refund.” And then all those collection actions they were holding off on? Yeah, those come back with a vengeance. Unlike a private lender who has to sue you in court, the IRS can administratively seize your wages and bank accounts without a judge’s approval. They’re what professionals call a “super-creditor.”

Paying Taxes with a Personal Loan

So what’s the other option? Well, you could take out a personal loan, use that money to pay tax debt to the IRS in full, and then you’re dealing with a bank or lender instead of the government.

The idea here is pretty straightforward: You’re basically transferring your debt from the IRS to a private lender. You get the cash, you write the IRS one big check, and boom—you’re square with Uncle Sam. Now you just owe a bank instead.

But here’s the catch: Personal loan interest rates can be brutal, especially if your credit isn’t great. The cost of a personal loan depends almost entirely on your credit profile. If you’ve got excellent credit (like 740+ score), you might qualify for rates around 10-11%. But if your credit is just okay or you’ve had some bumps in the road, that rate can shoot up to 20% or even 30%.

How Your Credit Score Affects Your Options

Let me give you the real numbers based on 2026 lending data:

| Credit Category | FICO Score Range | Estimated APR (3-Year) | Estimated APR (5-Year) |

| Excellent | 720 – 850 | 10.87% | 15.75% |

| Very Good | 670 – 739 | 13.73% | 18.69% |

| Good | 630 – 669 | 20.21% | 23.72% |

| Fair/Bad | Below 630 | 29.13% | 30.98% |

See that spread? If you’ve got excellent credit, you’re looking at around 11% for a three-year loan. Not terrible. But if your score is in the “Good” range (which is where a lot of people sit), you’re suddenly paying 20% or more. That’s credit card territory, and it’s way more expensive than what the IRS charges.

A word of warning: Personal loan rates tend to be significantly higher than the interest rates on an IRS Installment Agreement, especially if your credit profile is weaker. And there’s another hidden cost many people forget about—origination fees. Some lenders charge anywhere from 1.85% to 12% of your loan amount just to give you the money. On a $20,000 loan, that could be an extra $400 to $2,400 right off the top.

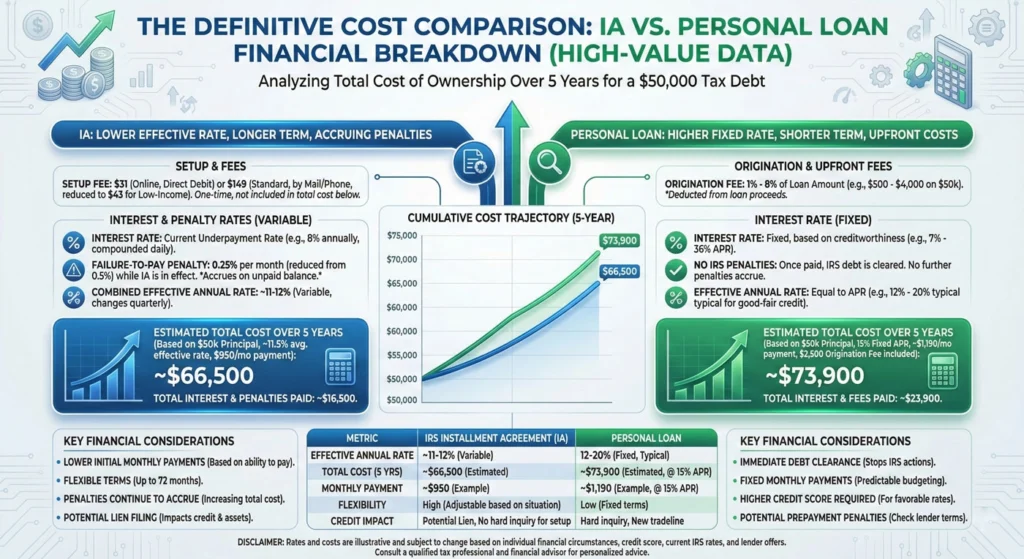

The Definitive Cost Comparison: Real Case Studies from 2026

Alright, this is where things get real. I’m gonna show you two detailed case studies with actual numbers so you can see exactly what we’re talking about here.

Case Study #1: The $20,000 Tax Bill (Most Common Scenario)

Let’s say you’re a typical taxpayer with a FICO score around 700—that’s what most professionals call “Good” credit. You owe $20,000 in taxes and want to pay it off over three years (36 months). Here are your two options:

Option A: IRS Streamlined Installment Agreement

You apply online and choose Direct Debit to get the lowest setup fee.

- Principal: $20,000

- Interest Rate: 7% (compounded daily)

- Failure-to-Pay Penalty: 0.25% per month

- Setup Fee: $22

- Projected Total Interest (3 Years): $2,232

- Projected Total Penalties (3 Years): $956

- Total Amount You’ll Pay: $23,210

- Monthly Payment: ~$645

Option B: Private Personal Loan

With a FICO of 700, you qualify for a 12% APR from a reputable lender like Discover or LightStream (assuming you find one with no origination fee).

- Principal: $20,000

- APR: 12% (simple interest)

- Origination Fee: $0 (if you’re lucky)

- Total Interest (3 Years): $3,912

- Total Amount You’ll Pay: $23,912

- Monthly Payment: ~$664

The Verdict: The IRS installment agreement saves you $702 over three years, and your monthly payment is $19 lower. For most people in this situation, the IRS plan is the clear winner.

But here’s the key insight: The “break-even point” is around 10% APR. If you can snag a personal loan with an interest rate below 10%, the private loan might actually be cheaper. But most people with “Good” credit can’t get rates that low—you usually need a score above 740 to qualify for single-digit rates.

Case Study #2: The $50,000 Tax Bill (Larger Liability)

Now let’s look at a bigger debt. This is where things get more complicated because at $50,000, you’re entering territory where the IRS might file a Notice of Federal Tax Lien, which becomes part of the public record.

Option A: IRS Simple Payment Plan (60 Months)

This uses the newer 2026 “Simple Payment Plan” that allows up to 10 years to pay without extensive financial disclosure.

- Principal: $50,000

- Repayment Term: 5 years (60 months)

- Interest Rate: 7% compounded daily + 0.25% monthly penalty

- Estimated Total Interest and Penalties: $12,000 – $18,000 (depending on payment timing)

- Total Amount You’ll Pay: ~$65,000

- Monthly Payment: ~$1,083

But here’s the catch: For debts over $50,000, the IRS may file a federal tax lien, which is public record. It doesn’t hit your credit score anymore (credit bureaus stopped reporting tax liens in 2018), but it’s still searchable by anyone doing a public records search. If you’re a lawyer, accountant, security clearance holder, or in any profession where public trust matters, this can be a career-killer.

Option B: Personal Loan (60 Months)

Let’s say you have excellent credit (FICO 740+) and qualify for a 10.87% APR. But to actually get $50,000 in your pocket, you need to borrow slightly more to cover the origination fee.

- Amount Needed: $50,000 for the IRS

- Origination Fee (3%): $1,500

- Total Borrowed: $51,546 (to net $50,000 after fees)

- APR: 10.87%

- Total Interest: ~$15,500

- Total Amount You’ll Pay: ~$67,046

- Monthly Payment: ~$1,117

The Verdict: The IRS agreement saves you about $2,000 over five years. But—and this is crucial—the personal loan keeps the debt private. There’s no public record, no lien filing, nothing that shows up when someone searches your name.

For many professionals, that $2,000 difference is essentially a “privacy fee” they’re willing to pay to keep their tax problems out of the public eye. If you’re in a profession where a tax lien could cost you your license or security clearance, the personal loan might be worth the premium.

Understanding the Hidden Math: Daily Compounding

Here’s something most people don’t realize about IRS debt: Unlike most personal loans that use simple interest, the IRS compounds interest daily. That means every day, they calculate interest on your remaining balance (including previously accrued interest), and that becomes your new balance for the next day.

The formula looks like this (for my fellow math nerds):

A = P × e^(rt)

Where:

- A = final amount you owe

- P = principal (your original tax bill)

- r = annual interest rate (0.07 for 7%)

- t = time in years

What this means in plain English: That 7% IRS interest rate isn’t quite as simple as it sounds. By the time you factor in daily compounding plus the 0.25% monthly penalty (which adds another 3% annually), your effective annual cost is closer to 10%. Still usually better than a personal loan if your credit is average, but not quite the bargain it appears to be at first glance.

How Recent Tax Law Changes Affect Your Decision (2026 Update)

Here’s something important: The tax landscape changed significantly with the “One Big Beautiful Bill” (officially called the Working Families Tax Cut Act) that was signed into law on July 4, 2025. This affects how much you might owe in the first place and how much money you have available to pay down debt.

Key Changes That Might Help You:

Higher Standard Deduction: For married couples filing jointly, the standard deduction jumped to $31,500. This might mean you owe less tax in future years, freeing up cash to pay down your existing debt faster.

No Tax on Tips and Overtime: Through 2028, qualified workers can exclude tips and overtime from taxation. If you’re in a tipped profession (like restaurant service) or regularly work overtime, you might suddenly have thousands of extra dollars that aren’t going to taxes—money you can redirect to paying off your IRS debt.

Increased SALT Deduction: The state and local tax deduction cap increased from $10,000 to $40,000. If you’re in a high-tax state like California or New York, this could significantly lower your overall tax bill.

New Car Loan Interest Deduction: You can now deduct up to $10,000 in car loan interest if you buy a U.S.-assembled vehicle. This opens up some interesting strategic possibilities—some taxpayers are now choosing to carry car debt (which is tax-deductible) while using their available cash to pay off the IRS (which isn’t deductible).

The point is: Your total financial picture matters. Don’t look at your tax debt in isolation. Think about your whole situation.

Credit Score Impact: The Hidden Advantage of IRS Plans

Here’s something that might surprise you: An IRS installment agreement is basically invisible to your credit score. As long as you’re making your payments on time, it doesn’t show up on your credit report at all. It’s not counted in your debt-to-income ratio, it doesn’t appear as a tradeline, nothing.

A personal loan, on the other hand, is very visible. It shows up as a new account, creates a hard inquiry when you apply, increases your total debt balance, and affects your debt-to-income ratio. In the short term, this can actually lower your credit score a bit.

But here’s the twist: That visibility can also work in your favor if you’re trying to rebuild credit. When you successfully repay a personal loan, all those on-time payments show up on your credit report. Payment history is 35% of your FICO score—the single biggest factor. The IRS doesn’t report your good behavior to the credit bureaus, so you get zero credit score benefit from faithfully paying them every month for three years.

So if you’re in a position where you need to rebuild your credit and you can afford the higher cost of a personal loan, there’s an argument for taking that route. You’re essentially paying extra to create a positive payment history on your credit report.

The 10-Year Collection Window (Something Most People Don’t Know)

Here’s a crucial detail that doesn’t exist with private loans: The IRS has a 10-year statute of limitations to collect tax debt, called the Collection Statute Expiration Date (CSED).

Let’s say the IRS assessed your tax debt on April 15, 2026. They have until April 15, 2036, to collect it. After that? The debt legally expires. Gone. They can’t touch you.

Now, don’t get any clever ideas—there are ways the CSED can get extended (like if you leave the country or file for bankruptcy), but for most people, that 10-year clock is real.

This creates an interesting dynamic: If you’re close to your CSED (let’s say you only have four years left), the IRS becomes much more aggressive because they’re “racing against the clock” to get their money before your debt expires. They might not approve a long-term payment plan if the math doesn’t work out.

A personal loan has no such “expiration date.” While private debts have state-specific statutes of limitations for lawsuits (usually 3-6 years), the debt itself doesn’t legally vanish the way federal tax debt can.

Essential Alternatives to an Installment Agreement

Okay, so what if neither of these options really works for you? Maybe the monthly payments are still too high, or maybe your financial situation is just… rough right now. Don’t panic. There are a few other roads you can explore:

1. Offer in Compromise (OIC):

This is the “settle for less” option. If you can prove to the IRS that you genuinely can’t pay the full amount you owe—like, it would create serious financial hardship—they might let you settle your debt for less than what you actually owe.

Sounds great, right? Well, it’s not easy to qualify for. You need to fill out Form 656 and provide detailed financial statements showing your income, expenses, assets, everything. The IRS basically wants to see that squeezing the full amount out of you would be like trying to get blood from a stone.

But if you do qualify, it can be life-changing. Just know that it’s a rigorous process and most applications get rejected, so it’s worth talking to a tax professional about whether this is realistic for your situation.

2. Currently Not Collectible (CNC) Status:

This one’s for when paying your tax debt right now would literally prevent you from covering basic living expenses. We’re talking rent, food, utilities—the essentials.

If you can prove financial hardship, the IRS can put your account in CNC status, which basically means they pause collection actions. No payment plan, no levies, they just… wait.

BUT (and this is important): Interest and penalties still keep piling up. Your debt is growing while you’re in CNC status. Plus, the IRS can file a tax lien, which hits your credit. And they’ll periodically review your finances to see if your situation has improved. Once it does, they’ll expect you to start paying again.

Think of CNC status as hitting the pause button, not the delete button.

3. Penalty Abatement:

Sometimes you can actually get the IRS to reduce or completely remove penalties (and sometimes even interest) if you’ve got a good reason for why you couldn’t pay on time.

Good reasons include things like serious illness, natural disasters, loss of financial records due to circumstances beyond your control—basically stuff that wasn’t your fault. There’s also something called First-Time Penalty Abatement (FTA), which is exactly what it sounds like: if you’ve been a good taxpayer up until now and this is your first time messing up, they might cut you some slack.

If you qualify for FTA and get that 0.25% monthly penalty waived entirely, suddenly the IRS’s effective cost drops significantly—making it even more competitive with personal loans.

It doesn’t hurt to ask, especially if you’ve got legitimate reasons for falling behind. The worst they can say is no.

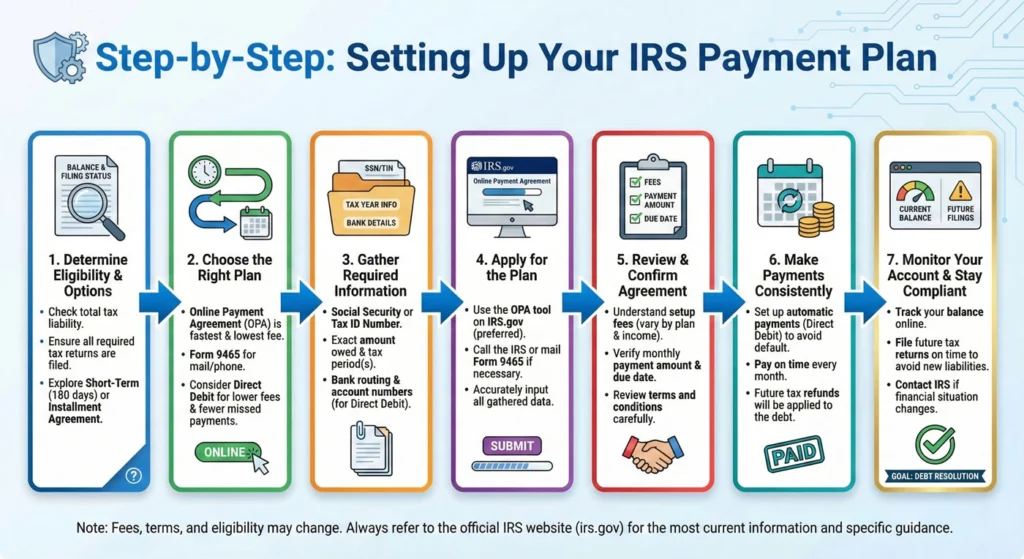

Step-by-Step: Setting Up Your IRS Payment Plan (Application Process)

Alright, so you’ve decided an IRS Installment Agreement is the way to go. Smart choice! Here’s exactly how to set it up without losing your mind in the process:

Step 1: Determine Eligibility and File Returns

First things first—make sure all your past-due returns are filed. I know, I know. If you owe money, the last thing you want to do is file returns that are gonna show more debt. But the IRS won’t even talk to you about a payment plan until you’re current on filing.

Then check how much you owe against the plan limits. Remember, Streamlined Installment Agreements are for $50,000 or less, Short-Term plans are for under $100,000, and so on. Know which category you fall into.

Step 2: Choose the Right Plan

Based on your debt size and how long you need to pay it off, pick your plan type. Need six months or less and owe under 100K?Short−Term.Needuptosixyearsandoweunder50K? Long-Term or Streamlined. Can’t afford to pay the full amount even over time? Look into Partial Payment IA.

If you’re not sure which one makes sense, the IRS has people who can help (I know, shocking), or you can talk to a tax pro.

Step 3: Submit Your Application

You’ve got options here:

Online (Easiest): Use the IRS Online Payment Agreement (OPA) tool. It’s actually pretty user-friendly, and it’s the fastest way to get approved. Plus, you can do it in your pajamas at 2am if that’s your thing.

By Mail: Submit Form 9465 (Installment Agreement Request). If you owe more than $50,000, you’ll also need to include Form 433F with all your financial info.

Step 4: Optimize Payment Method

Here’s a pro tip that’ll save you money right off the bat: Set up Direct Debit (automatic payments from your checking account).

Why? Because the setup fee for direct debit is way cheaper:

| Application Method | Payment Type | Standard Fee | Low-Income Fee |

| Online | Direct Debit | $22 | $0 |

| Online | Non-Direct Debit | $69 | $43 (Reimbursable) |

| Phone/Mail/In-Person | Direct Debit | $107 | $0 |

| Phone/Mail/In-Person | Non-Direct Debit | $178 | $43 (Reimbursable) |

Plus, with automatic payments, you won’t forget to pay and accidentally default on your agreement. Win-win.

Strategic Decision Framework: Which Option Is Right for You?

After looking at all the data, case studies, and real-world examples, here’s my professional take on when each option makes sense:

Choose the IRS Installment Agreement if:

- Your credit score is below 700. Personal loan rates in the 20-30% range are absolutely brutal and will cost you way more than the IRS.

- You’re a low-income taxpayer. The fee waivers and accessibility of partial payment plans make the IRS your only realistic option.

- You have a clean tax history. If you can qualify for First-Time Penalty Abatement and get those penalties waived, the IRS becomes even cheaper.

- You need maximum payment flexibility. The new 10-year Simple Payment Plan gives you the lowest possible monthly payment.

- You want to keep your credit score intact. An IRS plan doesn’t appear on your credit report and won’t affect your ability to get other loans.

Choose a Personal Loan if:

- You have excellent credit (740+ FICO score). If you can secure an APR below 9-10%, you’ll mathematically beat the IRS’s effective cost.

- You’re in a profession sensitive to public records. Lawyers, accountants, security clearance holders—anyone for whom a tax lien filing would be professionally catastrophic should consider the “privacy premium” of a personal loan.

- You’re actively rebuilding your credit. A successfully repaid personal loan creates positive payment history on your credit report. The IRS doesn’t report your good behavior to credit bureaus.

- You have variable or increasing future income. Personal loans are fixed contracts. The IRS, however, reviews long-term agreements every two years and may demand higher payments if your income increases.

- You value simplicity and closure. Once you take out a personal loan and pay the IRS in full, you’re done with them. No more IRS notices, no annual reviews, just one simple payment to a bank each month.

Frequently Asked Questions

Let me tackle some questions I bet you’re already thinking about:

What is the minimum payment the IRS will accept?

Honestly? There’s no set minimum across the board. It depends on your total debt and your financial situation. The IRS looks at your income, your expenses, and your assets, then figures out what you can reasonably afford. For some people, that might be $50 a month. For others, it might be $500. It’s all about your specific circumstances.

Will the penalty and interest accumulate on a long-term payment plan?

Yep, afraid so. Both interest (currently 8% for individuals) and the failure-to-pay penalty (0.25% per month while you’re on an active plan) keep accruing daily until you’ve paid off the full balance. It’s not ideal, but it’s still usually cheaper than other options. The sooner you pay it off, the less you’ll pay overall in interest and penalties.

How long is the 72-month payment plan?

The 72-month payment plan is six years (72 months ÷ 12 months per year = 6 years). This is the longest duration for a Streamlined Installment Agreement, and it’s available to individuals who owe $50,000 or less. It’s a solid option if you need to stretch out those payments to keep them manageable.

What happens if I default on my IRS installment agreement?

This is where things get ugly. If you default—which means you miss a payment or fail to file your tax returns in future years—the IRS can terminate your agreement. Once that happens, all bets are off. They can restart aggressive collection actions like wage garnishments, bank levies, and property seizures. Plus, any remaining balance becomes due immediately. So yeah, definitely want to avoid defaulting. If you’re struggling to make a payment, reach out to the IRS before you miss it. Sometimes they can work with you.

Conclusion: Take Action Now, Thank Yourself Later

Look, I get it. Dealing with tax debt is stressful and not exactly fun dinner conversation. But here’s the thing: taking action now—even if it’s scary—is way better than ignoring it and letting the problem snowball.

Before you choose between an IRS Installment Agreement or a personal loan to pay tax debt, sit down and actually calculate the total costs for your specific situation. Look at:

- Your credit score and the interest rates you realistically qualify for

- The length of time you need to repay

- Setup fees and origination fees

- Your professional situation (will a tax lien hurt your career?)

- Whether you need to rebuild credit

Run the numbers using the frameworks and case studies I’ve shown you here. For most people with average credit, the IRS plan wins on pure cost. But if you’ve got stellar credit or professional reasons to keep things private, a personal loan might make sense despite the higher price tag.

The key to managing tax debt is picking the right plan for your unique financial situation and making sure your application is accurate and complete. A mistake on your application could delay everything or even get you denied, so take your time and do it right.

My honest advice? Because this stuff can get complex and mistakes can be crazy expensive, it’s often worth consulting with a tax professional or attorney. Yeah, it costs money upfront, but they can help you secure the best possible terms, avoid common pitfalls, potentially get penalties abated, and make sure you don’t accidentally default down the road.

At the end of the day, the IRS just wants their money. They’re not trying to ruin your life (even if it feels like it sometimes). Work with them, set up a plan that actually works for your budget, and stick to it. Future you will be so grateful you handled this like an adult instead of ignoring those scary letters.

You’ve got this! And remember—thousands of people set up IRS Installment Agreements every year and successfully pay off their debt. You’re not alone in this, and there’s a path forward that won’t destroy your finances.

The worst thing you can do is nothing. So take a deep breath, gather your paperwork, and take that first step today. Your financial peace of mind is worth it.