Look, I’m not going to sugarcoat it – planning your retirement as a federal employee feels a bit like trying to solve a Rubik’s cube blindfolded, doesn’t it? You’ve got FERS or CSRS (depending on when you started), the TSP, FEGLI, Social Security… and honestly, if you’re like most feds I talk to, you’re probably a little overwhelmed by the whole thing.

But here’s the thing: 2025 is not the year to put this off.

I know, I know – you’ve been meaning to figure out your federal employee pension situation for years. But this year is different. The retirement applications have absolutely exploded, creating a massive backlog at OPM that’s making people wait months longer than usual. And if that wasn’t enough to get your attention, there are some pretty scary legislative proposals floating around Congress that could seriously cut into your benefits. We’re talking real money here, folks.

So consider this your wake-up call (the friendly kind, with coffee and encouragement). In this guide, I’m going to walk you through everything you need to know about your federal employee pension calculator, the mistakes you absolutely want to avoid, and the strategies that’ll help you squeeze every penny out of your benefits. Think of this as your cheat sheet for navigating the federal employee pension system without losing your mind.

Ready? Let’s dive in.

Understanding Your Foundation: FERS vs. CSRS

Alright, first things first – we need to figure out which retirement system you’re in, because it makes a huge difference in how you calculate federal employee pension benefits.

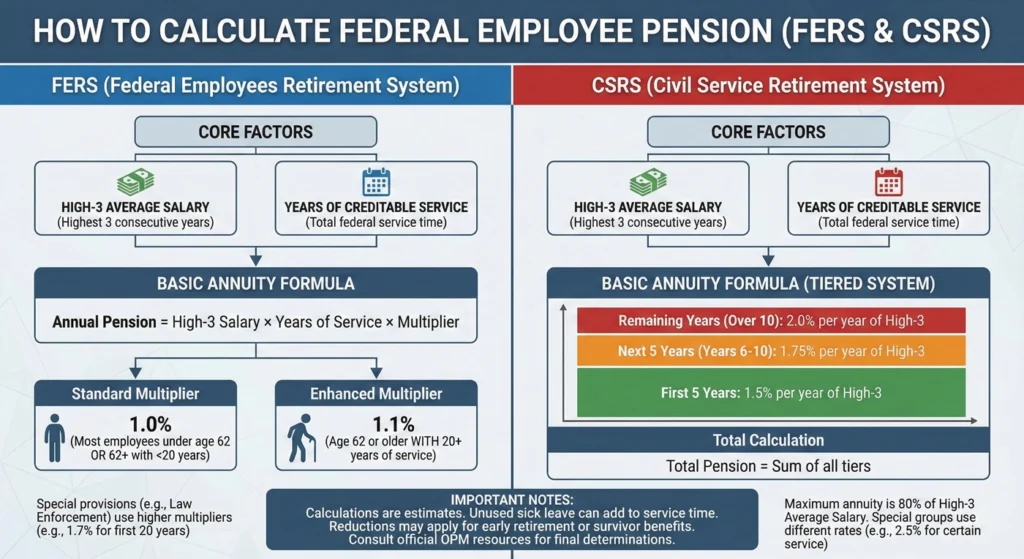

Here’s the deal: If you started your federal career before January 1, 1987, you’re probably in CSRS (the Civil Service Retirement System). It’s the older system, kind of like driving a classic car – simple, pension-focused, and honestly pretty generous. No Social Security integration, just a solid pension based on your years of service and salary.

But if you started after 1987 (which is most of you reading this), welcome to FERS – the Federal Employees Retirement System. This is more like a three-legged stool: you’ve got your FERS annuity, Social Security benefits, and the TSP (Thrift Savings Plan). All three legs need to work together to keep you stable in retirement.

Let me break down the key differences in a way that actually makes sense:

CSRS (The Old School):

- No Social Security integration (you don’t pay into it, don’t get it)

- Higher pension amounts (like, significantly higher)

- Employee contributions around 7-8% of salary

- Survivor gets 55% of your annuity

- Pretty much extinct unless you’re a unicorn who’s been around since the ’80s

FERS (The Modern Standard):

- You pay into Social Security and get those benefits later

- TSP with up to 5% agency matching (free money, people!)

- Employee contributions between 0.8% to 4.4% depending on when you were hired

- Survivor can get up to 50% of your annuity (but it costs you)

- Way more portable if you leave federal service

The big advantage of FERS? Flexibility and portability. If you decide to leave Uncle Sam’s employment, you can take your TSP with you and potentially get a deferred annuity later. With CSRS, you’re pretty much all-in or all-out.

FERS Annuity Maximization: The Age 62 Strategy

Okay, time to talk about the federal employee pension calculator and how your annuity actually gets calculated. This is where the magic (or math, but magic sounds cooler) happens.

FERS Annuity Calculation Explained

The formula is actually pretty straightforward once you break it down:

Your Annual Annuity = High-3 Salary × Years of Service × Multiplier

Let’s unpack this:

High-3 Salary: This is the highest average basic pay you earned during any three consecutive years of service. Usually, this is your last three years (because hopefully you’ve been getting raises), but not always. If you took a demotion or something, it might be an earlier period. And heads up – this is basic pay only. No overtime, bonuses, or locality pay counts here.

Years of Service: Pretty self-explanatory, but make sure you’re counting ALL your creditable service, including any military time you bought back, unused sick leave (yes, that counts now!), and any time from previous federal employment.

The Multiplier: And here’s where things get really interesting…

The Power of Time: Age 60 vs. Age 62

Most people don’t know this, but waiting until age 62 to retire can literally give you a 10% raise on your pension – for life. I’m not kidding.

Here’s the deal: If you retire at age 60 (or at your Minimum Retirement Age with 30 years), your multiplier is 1%. That means for every year of service, you get 1% of your High-3 salary.

But if you wait until age 62 and have at least 20 years of service, your multiplier jumps to 1.1%. That’s a 10% increase in your pension just for hanging around a couple more years!

Let me show you the math:

- High-3 Salary: $100,000

- Years of Service: 25 years

- Retiring at 60: $100,000 × 25 × 1% = $25,000/year

- Retiring at 62: $100,000 × 25 × 1.1% = $27,500/year

That’s an extra $2,500 every single year, adjusted for COLAs, for the rest of your life. Over a 25-year retirement, that’s more than $62,500 in extra income (before COLAs). Not too shabby for sticking around two more years, right?

The FERS Supplement (SRS) Explained

Now, if you’re thinking “But I want to retire before 62 and I need money to bridge the gap until Social Security kicks in,” well, FERS thought of that. It’s called the Special Retirement Supplement, or SRS for short.

The SRS is basically designed to approximate what you would’ve gotten from Social Security if you could claim it early. It’s only for FERS employees who retire before age 62 with an immediate, unreduced annuity.

Sounds great, right? But here’s the catch…

The Earnings Test Trap: Once you hit your Minimum Retirement Age (somewhere between 55 and 57 depending on your birth year), the SRS becomes subject to what’s called an excess earnings test. Translation: if you make too much money from working, your supplement gets reduced or even eliminated entirely.

For 2025, if you earn more than about $23,400 from W-2 wages, 1099 income, or self-employment, they’ll start clawing back your SRS at a rate of $1 for every $2 you earn over that limit.

The good news? Withdrawals from your TSP, your FERS annuity, IRA distributions, rental income, dividends – none of that counts as “earned income” for this test. So you can still have other income streams without penalty.

5 Financial Pillars & 10 Common Mistakes

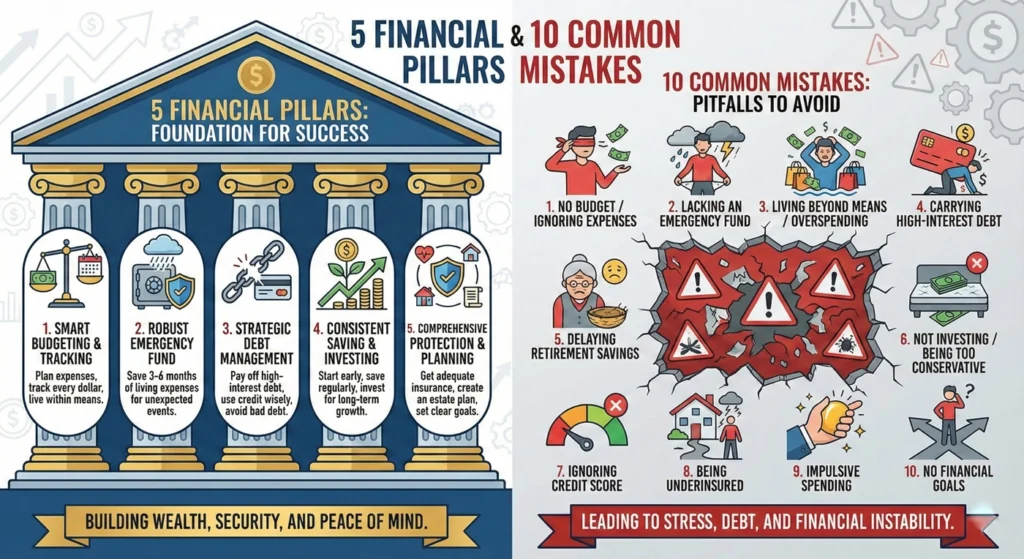

Alright, let’s get into the meat and potatoes – the mistakes I see federal employees making all the time, organized into five key areas you need to nail down.

Pillar 1: Income Planning & Timing

Mistake 1: Procrastinating Retirement Planning

Look, I get it. Retirement feels far away, and there are a million other things demanding your attention right now. But here’s the brutal truth: every year you wait to start planning seriously costs you money and options.

Start today. Not tomorrow, not next month, not when things “calm down” at work (spoiler alert: they won’t). Today. Even if it’s just 30 minutes to pull together your recent SF-50s and figure out your service computation date.

Mistake 2: Failing to Optimize Social Security

This is huge, and so many people mess it up. When you claim Social Security can make a difference of hundreds of thousands of dollars over your lifetime.

Claiming at 62 (the earliest possible) means accepting a permanently reduced benefit – we’re talking about a 30% reduction compared to waiting until your full retirement age. Wait until 70, and you get an extra 8% per year past your full retirement age (up to 24-32% more, depending on your birth year).

Factor this into your overall federal employee pension strategy. If you’ve got the FERS supplement bridging the gap, maybe it makes sense to delay Social Security and maximize that benefit.

Mistake 3: Overlooking the Survivor Benefit Plan (SBP)

This one’s tough because it involves thinking about, well, dying. But if you’re married, you need to have a serious conversation about survivor benefits.

Here’s what happens: By default, if you’re married, you’ll provide your spouse with a survivor annuity equal to 50% of your pension. But this isn’t free – it costs you a 10% reduction in your monthly pension (5% for a 25% survivor benefit).

Some people think “My spouse has their own pension, we’re good” and waive the survivor benefit. But consider this: if you die first, your spouse loses your entire annuity AND your Social Security income. Plus, they might lose FEHB eligibility if they don’t have their own federal employment or aren’t covered under the SBP.

Just… talk about it. Run the numbers. Make an informed decision.

Pillar 2: TSP and Investment Strategy

Mistake 4: Neglecting TSP Contributions

Okay, this might be the most expensive mistake on the whole list. The TSP is arguably one of the best retirement savings vehicles on the planet – seriously low fees, solid investment options, and free money from your agency match.

For 2025, you can contribute up to $23,500 to your TSP (or $31,000 if you’re 50 or older). And if you’re between 60-63, thanks to the SECURE Act 2.0, your catch-up limit is even higher – $34,750!

But here’s the bare minimum you should be doing: contribute at least 5% of your salary. Why? Because your agency matches up to 5% (1% automatic plus 4% matching). If you’re not contributing at least 5%, you’re literally leaving free money on the table. That’s not being thrifty; that’s being silly.

Mistake 5: Failing to Diversify Your TSP Portfolio

Let me guess – you’re 100% in the G Fund or you just picked a Lifecycle fund and never looked at it again? I see this all the time.

The G Fund is safe, sure. It won’t lose money. But it’s also not going to grow much, and inflation is going to eat away at your purchasing power like significantly.

And Lifecycle funds? They’re fine as a default option, but they can be really conservative with your money. Many federal employees would benefit from a more aggressive allocation, especially if you’re younger or have a longer time horizon.

Consider mixing the C Fund (S&P 500), S Fund (small-cap stocks), I Fund (international), F Fund (bonds), and G Fund based on your risk tolerance and time until retirement. Or at least understand what you’re invested in and make a conscious choice about it.

Pillar 3: Healthcare and Risk Management

Mistake 6: Misunderstanding FEGLI

FEGLI (Federal Employees’ Group Life Insurance) seems great when you’re young and the premiums are cheap. But here’s the problem: as you get older, those premiums skyrocket.

I’ve seen people in their 70s paying $500+ per month for FEGLI coverage that they really don’t need anymore. Maybe their house is paid off, kids are grown, and their spouse would be fine with the pension and TSP. But they’ve had FEGLI for decades, so they just keep paying.

Or worse, they drop FEGLI late in life and then realize they can’t qualify for private coverage due to health issues.

Here’s my advice: in your 50s, get a term life insurance policy from the private market (if you’re healthy enough to qualify) to lock in lower rates. Then you can drop FEGLI before the costs become prohibitive, and when your term policy ends, you hopefully won’t need life insurance anymore anyway.

Mistake 7: Underestimating Healthcare Costs

Healthcare is probably going to be your biggest expense in retirement, even bigger than your mortgage (if you still have one).

The good news: FEHB continues into retirement if you’ve been enrolled for the five years immediately before you retire. The bad news: premiums have been climbing steeply. In 2025, we saw an average increase of 13.5% across FEHB plans. Ouch.

At age 65, you’ll become eligible for Medicare Part A (free) and Part B (about $175/month in 2025, more if you’re high-income). Here’s the big question: do you keep FEHB and have it coordinate with Medicare, or do you drop FEHB and get a Medigap plan?

There’s no one-size-fits-all answer. If FEHB premiums keep increasing at this rate, Medigap plus Part D prescription coverage might end up being cheaper for many retirees. But FEHB is really comprehensive coverage, so it’s a trade-off.

Pillar 4: Tax Efficiency

Mistake 8: Neglecting Tax Considerations

This is where things get fun (if you think taxes are fun, which I kind of do, but I’m weird like that).

Here’s what you need to know: Your FERS annuity is fully taxable as ordinary income. Traditional TSP withdrawals? Also fully taxable. And up to 85% of your Social Security benefits can be taxable too, depending on your total income.

That’s a lot of taxable income hitting all at once in retirement. So what can you do?

One strategy is Roth conversions. If you have years between retirement and age 72 (when Required Minimum Distributions kick in) where your income is lower, you might want to convert some traditional TSP money to Roth. You’ll pay taxes now at a lower rate, and then that money grows and withdraws tax-free forever.

Another consideration: balancing traditional and Roth TSP contributions during your working years. The traditional contributions lower your taxes now; Roth contributions mean tax-free withdrawals later. Which is better? Depends on whether you think your tax rate is higher now or will be higher in retirement.

Bonus Strategy: Maximize Your HSA

If you’re enrolled in a high-deductible health plan, you have access to what I call the “secret weapon” of retirement savings: the Health Savings Account.

The HSA has a triple tax advantage:

- Contributions are tax-deductible

- Growth is tax-deferred

- Withdrawals for qualified medical expenses are tax-free

That’s better than a 401(k)/TSP (taxable withdrawals) and better than a Roth (no deduction going in). For 2025, you can contribute up to $4,300 for self-only coverage or $8,550 for family coverage (plus $1,000 catch-up if you’re 55+).

Pro tip: Max out your HSA contributions and don’t touch the money. Pay for medical expenses out of pocket, invest the HSA funds, and let them grow tax-free for decades. In retirement, you can reimburse yourself for all those medical expenses you paid (save your receipts!), or just use the HSA to pay for healthcare costs tax-free.

Pillar 5: Comprehensive Strategy

Mistake 9: Ignoring Inflation

Inflation is the silent killer of retirement plans. Even at just 3% per year, your purchasing power gets cut in half every 24 years.

The good news: FERS annuities get COLAs (Cost of Living Adjustments). The bad news: FERS COLAs are calculated differently than CSRS COLAs, and they don’t start until you’re 62 (unless you’re a special category employee like law enforcement).

Plus, if inflation is running at 4% but your COLA is only 3%, you’re still losing ground.

Your defense against inflation? Keep a portion of your investments in assets that have historically outpaced inflation, like stocks. Yes, even in retirement. And regularly review and adjust your spending plan to account for rising costs.

Mistake 10: Not Having a Comprehensive Retirement Plan

Here’s the thing: your FERS annuity, TSP, Social Security, FEHB, FEGLI – they’re all connected. Decisions you make about one affect the others.

Like, if you’re planning to work part-time in retirement, that might kill your FERS supplement. If you delay Social Security, you might need to pull more from your TSP early on. If you drop FEGLI, you might want more TSP money set aside for your survivors.

This is where it really helps to work with a financial advisor who specializes in federal benefits. Not just any advisor – one who actually understands the federal employee pension system inside and out. Trust me, your cousin’s financial advisor who mostly works with private sector clients probably doesn’t know the nuances of the FERS supplement or how creditable service works.

Deep Dive: Real Numbers in Action

Alright, we’ve covered the theory. Now let’s see how all of this actually plays out with real scenarios using 2025 numbers. I want you to see exactly how these decisions translate into dollars – because abstract percentages don’t pay your bills in retirement.

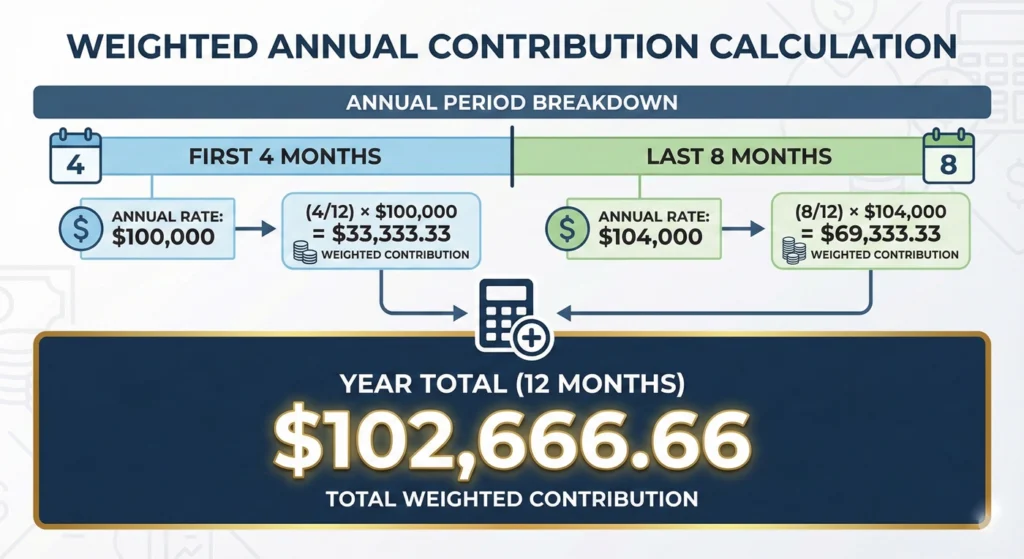

The High-3 Calculation: It’s More Precise Than You Think

Before we jump into the case studies, let’s clarify something about the High-3 that trips people up. It’s not just “your last three years of salary” – it’s a time-weighted average calculated down to the day.

Here’s what I mean. Say your salary changed mid-year due to a promotion:

| Period | Duration | Annual Rate | Weighted Contribution |

|---|---|---|---|

| First 4 months | 4 months | $100,000 | $33,333.33 |

| Last 8 months | 8 months | $104,000 | $69,333.33 |

| Year Total | 12 months | — | $102,666.66 |

OPM calculates this precisely across your highest 36 consecutive months (78 pay periods). For most people, that’s your final three years – but if you took a demotion or moved to a lower-locality area late in your career, your High-3 might actually be anchored in an earlier period.

The Locality Pay Factor: Here’s something important – locality pay IS included in your High-3 for FERS. For 2025, the DC area locality adjustment is 33.94%. That’s a massive premium over the “Rest of U.S.” rate. This creates a legitimate strategy: if you can spend your final three years in a high-locality area like DC, San Francisco, or New York, you permanently boost your lifetime annuity – even if you retire to a low-cost area afterward. Your pension follows you; the locality doesn’t.

What Doesn’t Count: Overtime, bonuses, cash awards, holiday pay, and lump-sum payments for unused annual leave. I’ve seen employees earning $150,000 annually – $100,000 base plus $50,000 in overtime – who planned their retirement based on the gross figure. Their pension? Based on the $100,000. That’s a painful surprise.

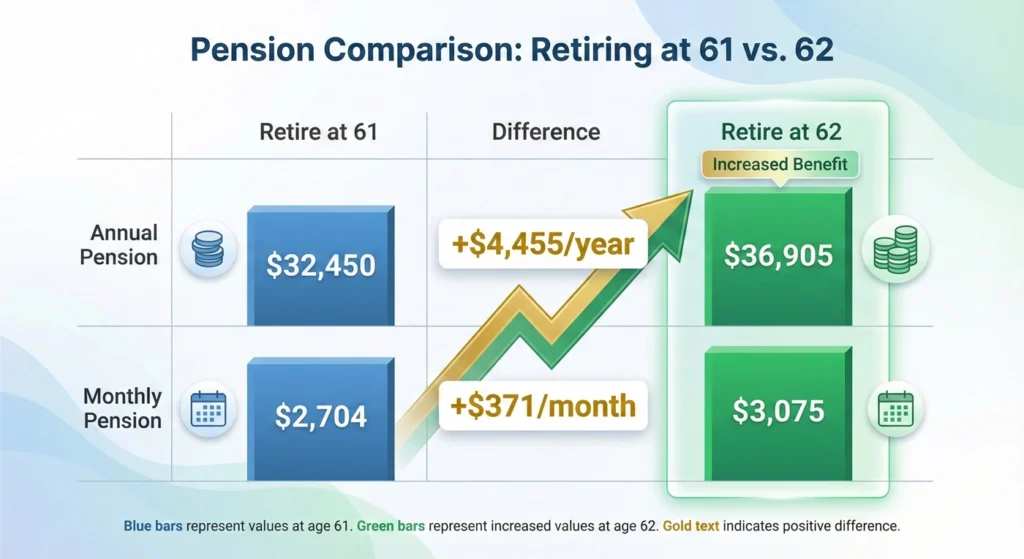

Case Study 1: Robert’s “Golden Handcuffs” Decision

Let me introduce you to Robert. He’s wrestling with the exact decision thousands of federal employees face every year.

Robert’s Profile:

- System: FERS

- Current age: 61

- Service: 29 years

- High-3: $110,000 (DC Area)

- Unused sick leave: 1,044 hours

First, let’s convert that sick leave. Using the 2,087-hour federal work year, 1,044 hours equals approximately 6 months of creditable service for computation purposes (remember: sick leave can’t make you eligible for retirement, but it does boost your calculation once you’re eligible).

Scenario A: Robert Retires Now at Age 61

Total creditable service: 29.5 years (29 years + 6 months sick leave)

Multiplier: 1.0% (because he’s under 62) Annual Annuity=$110,000×29.5×0.01=$32,450

Plus, here’s the kicker – no COLA until he turns 62. If inflation runs at 3% for that year, his purchasing power erodes immediately.

Scenario B: Robert Works One More Year and Retires at 62

Total creditable service: 30.5 years (30 years + 6 months sick leave)

Multiplier: 1.1% (age 62 with 20+ years – the magic threshold) Annual Annuity=$110,000×30.5×0.011=$36,905

The Bottom Line:

| Period | Retire at 61 | Retire at 62 | Difference |

|---|---|---|---|

| Annual Pension | $32,450 | $36,905 | +$4,455/year |

| Monthly Pension | $2,704 | $3,075 | +$371/month |

That single year of work doesn’t just add another 1% – it upgrades ALL 30.5 years from 1.0% to 1.1%. Robert isn’t gaining $1,100 (one year at 1%); he’s gaining $4,455 because the multiplier boost is retroactive.

Here’s another way to think about it: To generate an extra $4,455 per year from investments using a 4% safe withdrawal rate, Robert would need an additional $111,375 in his TSP. One year of work versus accumulating $111,000 more in savings. The math is pretty compelling.

Robert’s COLA situation also improves dramatically. At 62, he starts receiving cost-of-living adjustments immediately. Over a 25-year retirement with even modest 2% average COLAs, that gap between $32,450 and $36,905 compounds significantly.

Case Study 2: Sarah’s Military Buyback Decision

Sarah served four years of active duty before joining federal civilian service. She’s been putting off the military deposit decision, and now she’s wondering if it’s worth the hassle.

Sarah’s Profile:

- System: FERS

- Civilian service: 10 years

- Military service: 4 years (honorable discharge)

- High-3: $95,000

- Total military basic pay (over 4 years): $120,000

The Deposit Calculation:

For FERS, the military service deposit is 3% of basic military pay earned during the service period. Deposit=$120,000×0.03=$3,600

But here’s where timing matters. There’s a two-year interest-free grace period from your first civilian employment date. After that, interest starts compounding annually. For 2025, the interest rate jumped to 4.375% – up from around 3% in 2024.

Let’s say Sarah has been a civilian employee for 12 years and never paid the deposit. Her $3,600 base has been accruing interest for 10 years. With compound interest, she might now owe closer to $5,500-$6,000.

For this example, let’s assume she owes approximately $4,500 with accumulated interest.

The Benefit Calculation:

If Sarah pays the deposit, she adds 4 years to her creditable service. Her pension calculation becomes:

Without buyback: $95,000 × 10 years × 1.0% = $9,500/year

With buyback: $95,000 × 14 years × 1.0% = $13,300/year Annual Increase=$13,300−$9,500=$3,800/year

Return on Investment: Break-even=$3,800$4,500=1.18 years

Sarah recovers her entire deposit in about 14 months of retirement. If she lives 25 years post-retirement, that $4,500 investment generates $95,000 in additional pension payments – and that’s before COLAs.

The Critical Point: If Sarah doesn’t pay the deposit, those 4 years of military service simply don’t count toward her FERS pension. Ever. The military time vanishes from the calculation entirely.

For CSRS employees, the stakes are even higher due to the “Catch-62” rule. If you have a CSRS component and don’t pay your military deposit, when you turn 62 and become eligible for Social Security, your military years get stripped from your CSRS annuity calculation – resulting in a sudden, permanent reduction in your pension.

Sarah’s Decision: The buyback is essentially mandatory for rational financial planning. Even at the elevated 2025 interest rate of 4.375%, the math overwhelmingly favors paying the deposit as soon as possible.

Case Study 3: Mark’s Special Provision Early Retirement

Mark is a federal law enforcement officer who’s been on the job for 25 years. He’s eligible for special provision retirement – and the math works differently than regular FERS.

Mark’s Profile:

- System: FERS Special (Law Enforcement)

- Current age: 50

- Service: 25 years (all in covered LEO positions)

- High-3: $140,000 (includes LEAP – Law Enforcement Availability Pay)

The Special Provision Formula:

Law enforcement officers, firefighters, air traffic controllers, and nuclear materials couriers use an accelerated accrual schedule to compensate for mandatory early retirement (typically age 57 or 20 years of service) and the physical demands of their roles.

First 20 years: 1.7% per year

Years beyond 20: 1.0% per year

Mark’s Calculation: First 20 years=$140,000×20×0.017=$47,600 Next 5 years=$140,000×5×0.01=$7,000 Total Basic Annuity=$47,600+$7,000=$54,600/year

That’s a 39% replacement rate at age 50 – compared to the 25% a regular FERS employee would receive with the same tenure and salary.

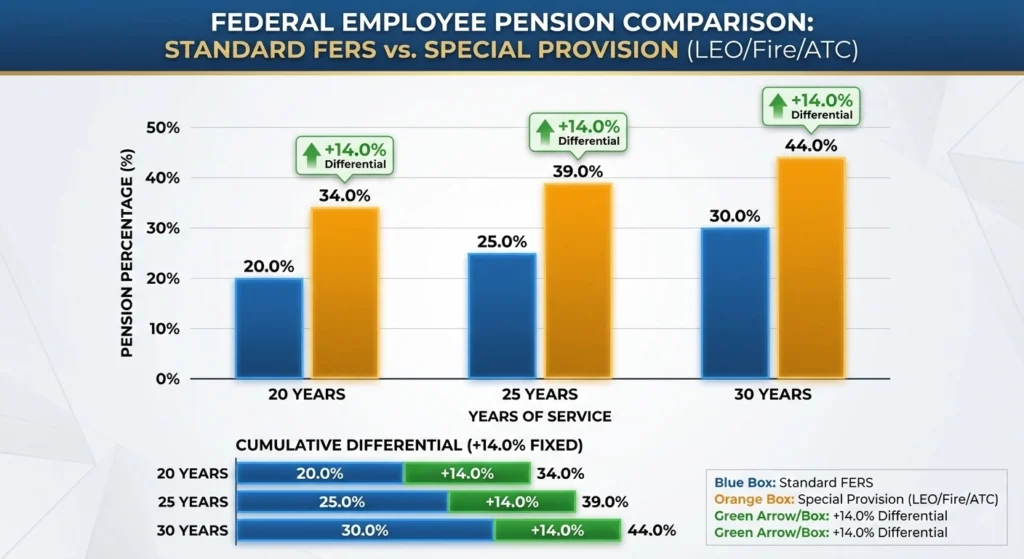

Comparison: Standard FERS vs. Special Provision

| Years of Service | Standard FERS | LEO/Fire/ATC | Differential |

|---|---|---|---|

| 20 years | 20.0% | 34.0% | +14.0% |

| 25 years | 25.0% | 39.0% | +14.0% |

| 30 years | 30.0% | 44.0% | +14.0% |

That consistent 14% differential is the “hazardous duty premium” built into the system.

Mark’s Additional Benefits:

The FERS Supplement (SRS): Mark receives this immediately upon retirement. The formula estimates his Social Security benefit earned during federal service: SRS≈Estimated SS at 62×40FERS Years

If Mark’s estimated Social Security at 62 is $2,500/month, his supplement would be approximately: SRS=$2,500×4025=$1,562/month (roughly)

The Earnings Test Exception: Here’s a major advantage for special provision retirees. Mark can take a post-retirement job earning $100,000 per year and NOT have his supplement reduced – until he reaches his Minimum Retirement Age (around 57). Regular FERS retirees face the earnings test immediately upon reaching their MRA, but special provision employees get this grace period.

Immediate COLAs: Unlike regular FERS retirees who typically wait until age 62 for cost-of-living adjustments, special provision retirees receive COLAs right away. At 2% annual inflation, that’s meaningful protection over the 12 years between Mark’s retirement at 50 and when regular FERS retirees would start receiving adjustments.

The Sick Leave Conversion: Every Hour Counts

Let’s look at how sick leave actually converts to service credit, because this is frequently misunderstood.

OPM uses a divisor of 2,087 hours (the standard federal work year). The conversion works out to approximately 174 hours per month of service credit.

Example Calculation:

| Sick Leave Hours | Service Credit |

|---|---|

| 174 hours | 1 month |

| 500 hours | ~2 months, 26 days |

| 800 hours | ~4 months, 18 days |

| 1,044 hours | ~6 months |

| 2,087 hours | 12 months (1 year) |

Important: The final calculation truncates to the nearest month – fractional months are dropped. This means 29 days of service equals zero additional months in your calculation.

Strategic Timing: If your actual service plus sick leave puts you at, say, 30 years, 2 months, and 23 days, your creditable service for calculation purposes is 30 years and 2 months. Those 23 days disappear. But if working one more day would push you to 30 years and 3 months, that day is worth an entire month of service credit.

Monetary Impact of Sick Leave:

For an employee with a $100,000 High-3 and the 1.1% multiplier (age 62+), each month of sick leave credit adds: $100,000×0.011×121=$91.67/month or $1,100/year

Over a 25-year retirement, one month of sick leave generates $27,500 in pension payments. That’s why “burning” sick leave before retirement – using it all up because you’re leaving anyway – is financially counterproductive. Those hours are literally worth money.

The Gross-to-Net Reality Check

Before we move on, let’s address something that blindsides many new retirees: the difference between your gross annuity and what actually hits your bank account.

Sample Net Calculation (Gross Annuity: $40,000)

| Deduction | Amount | Remaining |

|---|---|---|

| Starting Gross | — | $40,000 |

| Survivor Benefit (10%) | -$4,000 | $36,000 |

| Federal Income Tax (~12% effective) | -$4,320 | $31,680 |

| FEHB Premium (Family) | -$6,000 | $25,680 |

| Net Spendable | — | $25,680 |

That’s only 64% of the gross figure. And note that FEHB premiums in retirement are paid with after-tax dollars (unlike the pre-tax premium conversion available to active employees), effectively increasing the real cost of healthcare by 20-30% depending on your tax bracket.

If you’re planning retirement based on your gross annuity without modeling this “deduction stack,” you’re in for a rude awakening.

Navigating the 2025 Threats and Delays

Alright, now we need to talk about some stuff that’s happening right now that could seriously impact your retirement planning.

The OPM Backlog Crisis

Remember when I mentioned that retirement applications have exploded? Yeah, it’s bad.

OPM (the Office of Personnel Management) is currently taking an average of 70 days to process retirement applications. Seventy days! And that’s for straightforward cases. If your case is complicated – maybe you have military service, worked part-time, had a break in service, or have court orders (like for a divorce) – it could take even longer.

Here’s what this means for you:

Preparation Tactics:

- File Early: Don’t wait until 90 days before your retirement date. Start gathering your documents NOW. Get copies of all your SF-50s (personnel action forms), make sure your service computation date is correct, verify your TSP beneficiaries, update your address, all of it.

- Make Your Application Perfect: The number one cause of delays? Missing information, unsigned forms, conflicting information, or unaddressed court orders from divorces. Triple-check everything before you submit. Have someone else review it. Seriously, treat this like you’re submitting a doctoral dissertation.

- Understand Interim Pay: While OPM is processing your retirement, you’ll get “interim payments” – usually 60-80% of what your final annuity will be. But here’s the kicker: your FEHB and FEGLI premiums aren’t being deducted from these interim payments. When your annuity is finalized, OPM will come back and collect all those missed premiums in one lump sum. So don’t spend every penny of that interim pay and then get surprised by a bill for thousands of dollars.

Proposed Benefit Cuts & Legislative Alerts

Okay, deep breath. This part is frustrating, but you need to know about it.

There are some proposals floating around Congress right now that could significantly reduce federal employee benefits. These aren’t law yet, but they’re serious proposals that keep getting introduced.

The High-3 to High-5 Threat: Instead of calculating your annuity based on your highest three years of salary, the proposal would change it to your highest five years. This would almost certainly lower your pension, maybe by thousands of dollars per year. The current proposal would affect people retiring on or after January 1, 2027.

FERS Contribution Rate Increase: Currently, employees hired before 2013 contribute 0.8% of their salary to FERS. Those hired in 2013 contribute 3.1%, and those hired in 2014 or later contribute 4.4%. The proposal would standardize everyone at 4.4%, effectively cutting take-home pay for longer-serving employees.

Elimination of the FERS Supplement (SRS): Yeah, that bridge benefit we talked about earlier that helps you retire before 62? There’s a proposal to eliminate it entirely for anyone who becomes eligible after the date of enactment. Mandatory retirees (law enforcement, firefighters, etc.) would still get it, but regular feds wouldn’t.

What Should You Do?

First, don’t panic. These are proposals, not laws. They get introduced every few years, and most of them don’t pass.

But second, stay informed. Follow the news. Contact your congressional representatives and let them know how these proposals would affect you. The federal employee unions are fighting these, but your voice matters too.

And third, consider this another reason to have a solid backup plan. Max out that TSP. Build up your emergency fund. Don’t count on any one stream of income to carry your entire retirement.

Take Control of Your Retirement Security

Okay, we’ve covered a lot of ground here. Let me bring it home for you.

Your federal employee pension is a valuable benefit – honestly, one of the best retirement packages available in any sector these days. But it’s not a “set it and forget it” kind of thing. The landscape is changing. Backlogs are real. Legislative threats are real. Healthcare costs are skyrocketing.

The difference between a comfortable retirement and a stressful one often comes down to how proactive you were in planning. And I don’t just mean contributing to your TSP (though yes, do that). I mean really understanding how to calculate federal employee pension benefits, knowing when to retire to maximize your numbers, optimizing your survivor benefits, managing your taxes, planning for healthcare costs – all of it.

Use a federal employee pension calculator to run different scenarios. What if you retire at 60 versus 62? What if you claim Social Security at 62 versus 70? What if you work part-time in retirement? Run the numbers and see what makes sense for your situation.

And honestly? If you’re within 10 years of retirement, or really if you’re at any point where this stuff is starting to feel overwhelming, consider talking to a professional. Not just any financial advisor, but someone who specializes in federal benefits. These folks eat, sleep, and breathe FERS annuities, TSP strategies, and survivor benefit elections.

Many of them (like Federal Retirement Experts and others) offer free initial consultations or retirement analyses, especially for federal employees who are 55 or older. You’ll get a personalized report showing your projected benefits, identifying gaps in your plan, and giving you specific action items.

Look, you’ve worked hard for decades serving your country. You deserve a retirement where you’re not lying awake at night worrying about money or whether you made the right decisions with your benefits. So take control. Ask questions. Run the numbers. Make informed choices.

Your future self will thank you. And hey, maybe you’ll have enough left over to finally take that trip to Italy you’ve been talking about for years.

Now go forth and conquer that federal employee pension system. You’ve got this.