Okay, so here’s the thing about CPP Pension – it’s basically the retirement topic everyone’s talking about at dinner parties (well, maybe not fun dinner parties, but you know what I mean). And honestly? Most people are making this decision way too casually.

Here’s what usually happens: Someone hits 60, gets tired of the daily grind, and thinks “Hey, I can grab my CPP Pension now!” So they do. But here’s what they might not realize – by taking it early, they’re permanently locking in a way smaller payment for the rest of their lives. We’re talking about a 36% reduction that never goes away. Ouch.

But wait, there’s more (and this is the mind-blowing part): If you can hold off until you’re 70, you could be looking at a monthly payment that’s 121.9% higher than what you’d get at 60. That’s not a typo. We’re talking about potentially turning something like $640 a month into $1,420 a month. That’s the difference between “modest extra income” and “wow, this actually makes a real difference in my life.”

So in this post, I’m gonna walk you through the math (don’t worry, I’ll make it painless), explain the hidden perks nobody talks about, and yeah – I’ll also cover those specific situations where taking CPP early might actually make sense. Because let’s be real, personal finance is personal, and what works for your neighbor might not work for you.

Quick heads-up: to make this less abstract, I’m going to use one running example—Elena—a high-income professional trying to decide whether to start CPP at 60 or “let it bake” until 70. (If you’re not Elena, don’t worry. The strategy logic still applies; the numbers just change.)

- The Core Math: Understanding the Dramatic Age Adjustments

- The CPP Trifecta: Maximizing Longevity, Flexibility, and Tax Efficiency

- When Does Taking CPP Early Make Financial Sense? (Specialized Scenarios)

- CPP Complexities: Hidden Traps and Calculation Nuances

- CPP for Family-Owned Enterprise Owners: Tax and Succession Strategy

- Conclusion: Making Your Informed, Holistic CPP Decision

The Core Math: Understanding the Dramatic Age Adjustments

Alright, let’s talk numbers. I promise this won’t be as boring as watching paint dry.

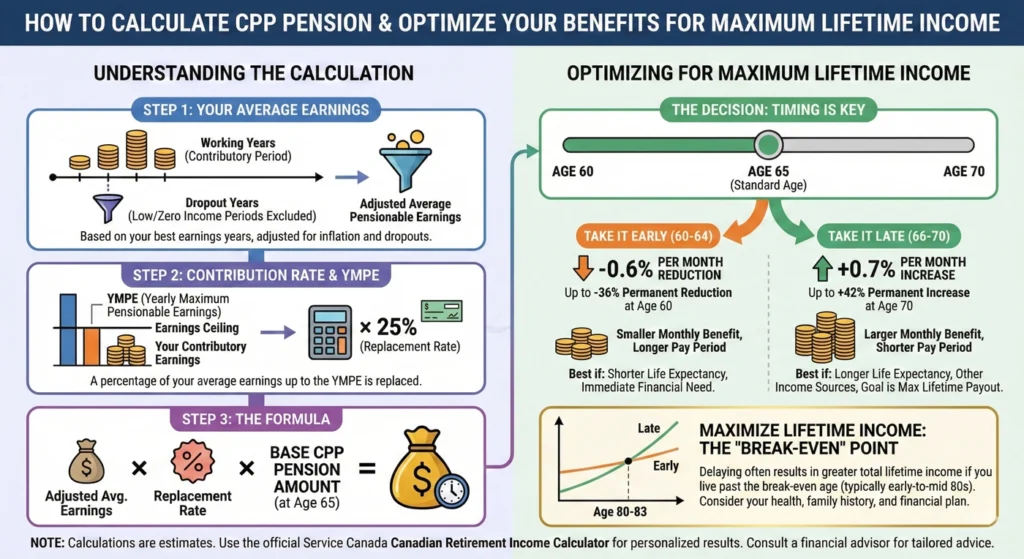

The Penalty vs. The Premium: Calculating Benefits at 60, 65, and 70

When you’re trying to figure out how to calculate CPP Pension amounts, the government basically has three main “stations” you need to know about:

Taking it at Age 60 (The “I’m Outta Here” Option):

If you take your CPP at 60, they’re gonna dock you 0.6% for every single month before your 65th birthday. Do the math (60 months x 0.6%), and boom – you’ve got a permanent 36% reduction. So if you would’ve gotten $1,000 a month at 65, you’re now getting $640. Forever. No backsies.

Taking it at Age 65 (The “Traditional” Choice):

This used to be considered the “normal” age to start collecting. It’s the baseline everyone measures against. Nothing fancy here – you get what you get based on your lifetime earnings and contributions.

Taking it at Age 70 (The “Patience is a Virtue” Play):

Now this is where it gets interesting. For every month you delay past 65, they bump you up by 0.7%. Wait the full five years until 70? That’s a sweet 42% increase on top of your age-65 amount.

The Mind-Bending Reality Check:

So let’s put this together. Between the 36% hit at 60 versus the 42% boost at 70, you’re looking at more than double the monthly income. That $640 at age 60? It becomes $1,420 at age 70. That’s not just a raise – that’s life-changing money, especially when you’re in your 80s and those extra dollars really count.

Case Study: Elena’s CPP Timing Decision (Why this isn’t a “small” choice)

Elena is 60, just stepped away from a high-paying job, and she’s eligible for a near-maximum CPP down the road because she spent most of her career earning at/above the CPP ceiling.

To keep it simple, let’s say Elena’s estimated CPP at 65 would be about $1,450/month.

Here’s what the exact same pension looks like at different start ages:

- If Elena starts CPP at 60:

$1,450×0.64≈$928/month

(That’s the permanent 36% reduction.) - If Elena starts CPP at 65:

About $1,450/month (the baseline). - If Elena delays CPP to 70:

$1,450×1.42≈$2,059/month

(That’s the permanent 42% increase.)

The “holy crap” difference:

Comparing 60 vs. 70, Elena is choosing between roughly $928/month and $2,059/month—a gap of about $1,131 every month (over $13,500/year) for as long as she lives.

What Elena actually does (the practical version):

- From 60 to 70, she spends from savings (often RRSP/RRIF planning comes into play here) so she doesn’t “need” CPP early.

- She treats the age-70 CPP as longevity insurance: bigger guaranteed income later, when market crashes and “oops I lived to 95” become very real problems.

- She also watches taxes: a larger CPP later can push income into zones where OAS clawbacks become a thing (thresholds change yearly, but think “around $90k+” net income as the starting line).

Key takeaway: If you can afford to delay, CPP is one of the rare decisions where patience can buy you a bigger, inflation-adjusted, government-backed paycheck for life.

Indexation: Why Delaying CPP Outperforms Inflation

Here’s something most people don’t know (and honestly, it’s kind of sneaky in a good way):

Once you start collecting your CPP Pension, your payments get indexed to regular old price inflation – the Consumer Price Index (CPI). So if a loaf of bread goes up 2%, your CPP goes up roughly 2%. That’s good!

But here’s the kicker: If you delay taking CPP, the value of that future pension grows with wage inflation instead. And historically, wages have gone up about 1% more per year than prices. Doesn’t sound like much, right? But over 5 or 10 years, that compounds into real money. It’s like your deferred CPP is getting a better interest rate just for sitting there waiting for you.

So when people calculate the break-even age for CPP, they often underestimate how much better the delayed option really is.

The CPP Trifecta: Maximizing Longevity, Flexibility, and Tax Efficiency

Okay, now we’re getting to the good stuff – the three massive reasons why waiting on CPP might be the smartest money move you make.

1. Protection Against Longevity Risk

Let’s talk about something nobody likes to think about but everybody should: What if you live really long? (I mean, that’s the goal, right?)

Here’s a fun stat that might freak you out a bit: If you’re a 60-year-old guy right now, you’ve got a 50/50 shot at making it to 89. And for women? Even longer odds of a long life. That’s potentially 30 years of retirement to fund!

Now imagine you took the smaller CPP payment at 60. Sure, you got more total payments, but now you’re 85, your savings are getting thin, and you’re stuck with that permanently reduced income. Not fun.

But if you waited until 70? You’ve got that fat, inflation-protected payment coming in every month, guaranteed by the government. It’s like having your own personal pension insurance policy. And here’s something cool for women especially – unlike private annuities that charge women more (because we tend to live longer), the CPP age deferral credit doesn’t care about your gender. Everyone gets the same deal.

2. Strategic Flexibility and RRSP/RRIF Drawdown

This is where things get strategic (in a fun way, I promise).

If you delay your CPP Pension, you’re basically creating this golden window in your 60s to do some tax wizardry with your RRSPs and other registered accounts. Think of it like this: You’ve got this decade where you can carefully drain those tax-deferred accounts at potentially lower tax rates, all while your CPP is “baking in the oven” getting bigger.

Why does this matter? Because once you hit 71, you’re forced to convert your RRSP to a RRIF, and then the government makes you take out minimum withdrawals whether you want to or not. And those forced withdrawals? They get taxed as regular income.

So smart folks do this: They draw down their RRSPs in their 60s (strategically, not excessive amounts), which shrinks the size of the RRIF later. Smaller RRIF = smaller forced withdrawals = lower taxes in your 70s and 80s. Meanwhile, your CPP is growing at 8.4% per year (that 0.7% per month compounds nicely).

Financial advisors who really know their stuff call this “letting the CPP bake a little longer while you eat the other pies first.” Yeah, we’re mixing metaphors, but you get it.

3. Lower Lifetime Taxes and OAS Clawback Mitigation

Speaking of taxes (everyone’s favorite topic, right?), here’s another huge benefit of the delayed CPP strategy.

When you’re smart about pulling money from your RRSPs in your 60s before CPP and Old Age Security (OAS) kick in, you can actually reduce your total lifetime tax bill. It’s like doing your homework now to avoid a bigger test later.

And here’s the big one: If you’re not careful, you could lose some of your OAS to something called the “clawback” (officially called the OAS recovery tax, but clawback sounds way more dramatic). Basically, if your total income goes over around $70,000-ish, the government starts taking back some of your OAS. And if you’re making over $105,000 or so, they can take it all back.

So by managing when and how much income you show each year, you can dodge that clawback and keep more of your money. It’s legal, it’s smart, and it’s exactly what you should be doing.

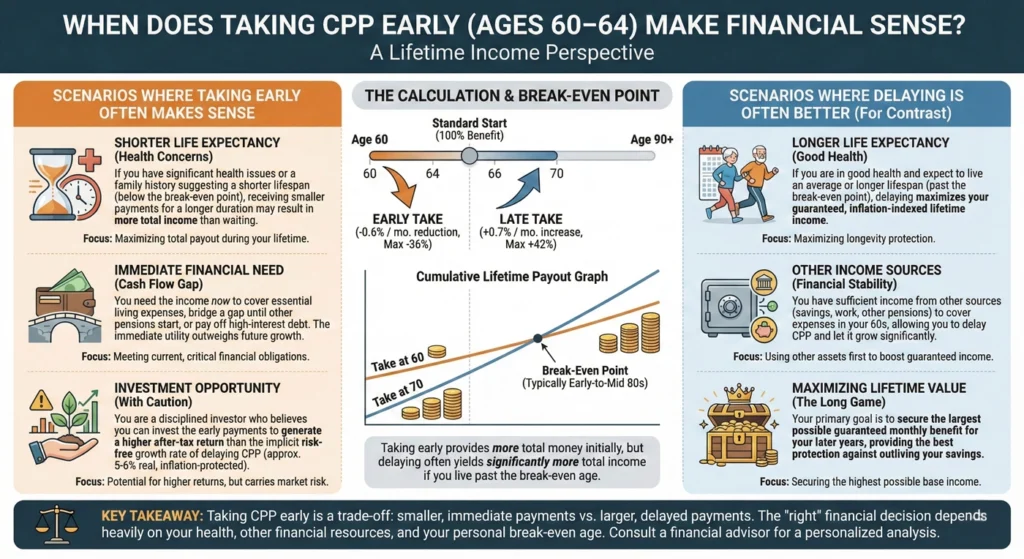

When Does Taking CPP Early Make Financial Sense? (Specialized Scenarios)

Okay, so I’ve been singing the praises of waiting, but let’s be honest – sometimes taking CPP early is actually the right call. Here’s when:

Immediate Financial Need and Health

Look, if you need the money right now to keep the lights on and food on the table, then all this “optimal strategy” stuff goes out the window. Real life trumps spreadsheets every time.

The “I Need Money Today” Situation:

If you’re 60, unemployed, and struggling to make ends meet, taking CPP early isn’t just reasonable – it’s necessary. There’s no shame in that. A smaller payment you can actually use is infinitely better than a theoretical bigger payment you might get if you can somehow survive ten more years without income.

The Health Factor:

Here’s a tough one: What if you have serious health concerns or a family history that suggests you might not make it to your 80s? In that case, taking CPP earlier might let you actually enjoy that money while you can.

The break-even point (where total payments catch up) for taking CPP at 60 versus waiting until 70 is usually somewhere between age 79 and 85, depending on whose calculator you believe. So if you’ve got good reasons to think you won’t make it that long, taking it early could maximize your total payout.

Low Income Strategies (Maximizing GIS)

This one’s a bit sneaky, but if you’re expecting to qualify for the Guaranteed Income Supplement (GIS) when you hit 65, taking CPP early at 60 might actually be brilliant.

Here’s the logic: GIS is this awesome tax-free benefit for low-income older people. But – and this is the catch – they reduce your GIS based on your taxable income, including CPP. So counterintuitively, having a smaller CPP payment (by taking it at 60) means you’ll show less taxable income after 65, which means you’ll get a bigger GIS payment that’s tax-free.

Mini Case Study: Arthur (When taking CPP at 60 can actually be the smart play)

Arthur is 60, has a history of low/uneven earnings, and expects to qualify for GIS at 65.

- If Arthur takes CPP at 65, let’s say he’d get $470/month.

- If he takes CPP at 60, that same benefit gets reduced by 36% to about $300/month.

Now the weird part: GIS is income-tested, and CPP counts as income. So the extra CPP Arthur gets by waiting can be partially (sometimes heavily) offset by lost GIS—meaning the “bigger CPP later” doesn’t always translate into “more money in his pocket later.”

Bottom line: for someone like Arthur, taking CPP early can provide (1) income from 60–64 when he needs it most, and (2) a lower CPP amount after 65 that may help preserve GIS.

It’s like choosing to get paid partly in tax-free dollars instead of fully taxable dollars. Pretty clever, right?

But heads up: This strategy requires some serious planning. You need to sell off capital assets and aggressively draw down RRSPs before you turn 65 to minimize your reported income when they calculate your GIS eligibility. It’s not simple, but for the right person, it can mean thousands more in after-tax income.

Navigating International Agreements (WEP)

This one’s super niche, but if you’ve worked both in Canada and the U.S., listen up.

There’s this thing called the Windfall Elimination Provision (WEP) that can reduce your U.S. Social Security if you’re also getting CPP. Without getting into the weeds (because trust me, it gets complicated), sometimes the smartest move is to take your CPP early (making it smaller) and delay your U.S. Social Security until 70 (making it bigger). This minimizes the WEP clawback.

If this applies to you, definitely talk to someone who specializes in cross-border retirement planning. This stuff will make your head spin.

CPP Complexities: Hidden Traps and Calculation Nuances

Alright, now we’re getting into the nitty-gritty stuff that can really trip people up. Stay with me here – this is important.

The Impact of Zero-Earning Years

Your CPP amount is based on your average earnings over your working life. But here’s the good news: they drop out your lowest 17% of contributory months. That’s about 8 years they just ignore.

But here’s where people get into trouble: Let’s say you retire at 55, stop working completely, and then wait until 65 to claim CPP (thinking you’re being patient and strategic). Well, now you’ve added 10 years of zero earnings to your record. If those 10 years exceed your “drop out” allowance, they’ll actually drag down your average earnings, giving you a smaller CPP pension base to work with.

It’s like getting a bigger slice (by waiting) of a smaller pie. Not exactly what you were hoping for, right?

The workaround? Keep working at least a bit, or make sure you understand how those zero years will affect your calculation. You can keep contributing to CPP even after you start collecting at 65, which can help replace some of those earlier low-earning years.

Survivor Benefits: Maximizing Protection, Avoiding the Cap

If you’re married or common-law, this section is crucial.

Generally, delaying your CPP until 70 means your spouse gets a bigger survivor benefit when you die. That’s good! But – and this is a big but – there’s a cap.

The combined total of someone’s own retirement pension plus their survivor benefit can’t exceed the maximum CPP benefit for one person at age 65. So if both you and your spouse are high earners who both maxed out CPP by waiting until 70, when the first person dies, the survivor might not see as much of a boost as they expected because they’re already hitting that cap.

It’s like when you and your friend both order the biggest burger on the menu – there’s just no room for fries on the plate anymore.

Mini Case Study: Jack (Why survivors often get less than they expect)

Jack is 68 and receiving his own CPP of $800/month. His wife just passed away; she was receiving a maximum pension of $1,300/month.

On paper: Jack should receive 60% of his wife’s pension as a survivor benefit.

$1,300×60%=$780/month

In reality: There’s that combined benefit cap we talked about. The sum of his retirement pension and survivor’s pension can’t exceed the maximum retirement pension (about $1,450 in 2025).

The math: $800 (Jack’s pension) + $780 (theoretical survivor benefit) = $1,580

This exceeds the maximum, so his actual survivor benefit gets reduced to approximately $650/month.

Result: Jack “loses” about $130/month of survivor benefit that he might have been counting on. For dual high-earner couples, this cap can significantly reduce the value of CPP survivor benefits—something few financial advisors discuss.

Planning tip: High-earning couples may want to consider supplemental life insurance to fill this gap rather than assuming CPP will cover survivor needs.

The Fix: Some couples buy life insurance to cover this potential income gap. It’s not romantic to think about, but it’s practical.

Accuracy of Government Estimates

Quick reality check: Those CPP estimates you get from the cpp pension board or Service Canada? Take them with a grain of salt, especially if your future earnings are going to look different from your past.

The online calculators often assume you’ll keep earning exactly what you’ve been earning, right up until 65. So if you’re planning to retire at 60 or ramp down to part-time work, those estimates can be way off. Don’t make major life decisions based on those numbers without understanding their limitations.

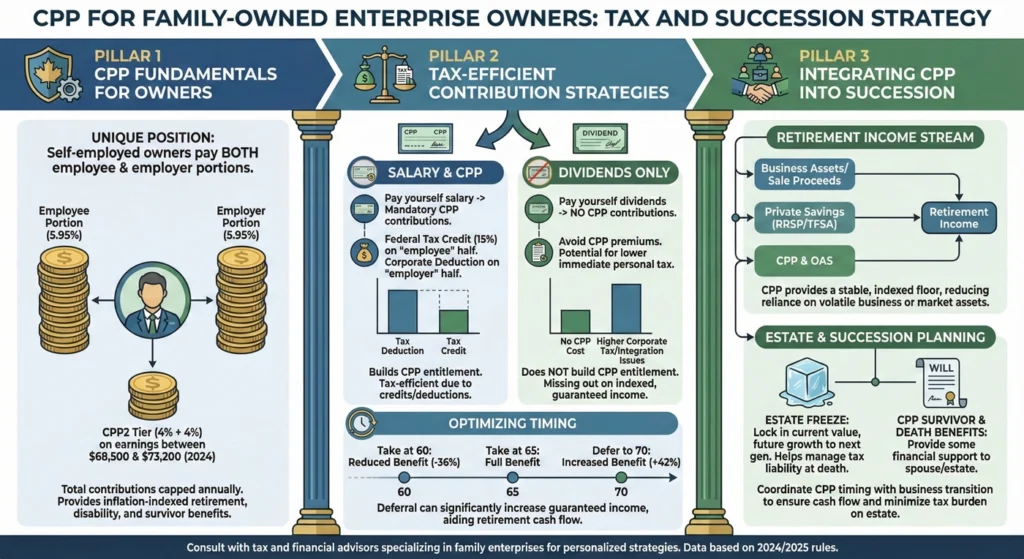

CPP for Family-Owned Enterprise Owners: Tax and Succession Strategy

If you’re self-employed or run your own business, this section is especially for you.

Contribution Planning for Self-Employed Individuals

Here’s something that stings: When you’re self-employed, you pay both the employer and employee portions of CPP contributions. That’s double what employees pay. And with the recent CPP enhancements (all that TIER 01 and TIER 02 stuff), if you’re earning above the Year’s Maximum Pensionable Earnings, your contribution rates are going up pretty sharply.

It feels like a lot of money going out the door right now, I know. But remember – you’re building that future pension that nobody can take away from you.

Mini Case Study: Sarah (Business Owner CPP Strategy)

Sarah is a 45-year-old consultant with an incorporated business netting $120,000. She’s trying to decide how to pay herself in 2025: salary or dividends?

Salary Strategy:

- To contribute to CPP, she needs to pay herself salary

- If she draws $81,200 in salary (2025 maximum pensionable earnings):

- She pays about $8,860 in CPP contributions (both employee and employer portions)

- But receives a tax credit on the base portion and a tax deduction on the enhanced portion

- She builds CPP credits that will provide guaranteed lifetime income later

- She gets CPP disability protection if something happens (often overlooked value!)

Dividend Strategy:

- Dividends aren’t pensionable earnings = $0 CPP contributions

- Immediate cash flow savings of $8,860

- But zero CPP credits earned for the year

- No disability insurance protection

- No survivor benefits accumulating for her family

What Sarah decided: With the recent CPP enhancement increasing the replacement rate to 33% and covering income up to $81,200, the “return” on CPP for business owners has actually improved. Sarah opts for a hybrid approach—enough salary to maximize CPP contributions, with remaining profits as dividends. She views CPP as “forced diversification” away from her business equity, creating retirement income that doesn’t depend on selling her company.

Business succession insight: As Sarah approaches retirement, she’ll likely coordinate her CPP timing with her business transition plan, potentially deferring CPP to age 70 while gradually selling or transferring the business, creating a “bridge” from business income to retirement income.

Integrating CPP Timing with Business Transition

If you own a business, thinking about your CPP timing should be part of your succession plan, not separate from it.

Here’s a strategy that works really well: Delay your CPP until 70 while you’re gradually transitioning the business to the next generation (whether that’s your kids, a business partner, or an outside buyer). As your business income slowly decreases during that transition period, your CPP pension is getting bigger and bigger. Then boom – at 70, you’ve got this solid, guaranteed, inflation-protected income stream replacing what you used to make from the business.

It’s like building a bridge from “business owner income” to “retirement income” instead of just jumping off a cliff.

Plus, don’t forget to factor in things like the CPP death benefit and survivor benefits when you’re doing your estate planning. These can provide crucial liquidity and security for your family.

Conclusion: Making Your Informed, Holistic CPP Decision

Okay, so we’ve covered a lot of ground here. Let’s bring it home.

The truth is, there’s no universal “right answer” for when to take your CPP Pension. It’s not like I can just say “Everyone should wait until 70!” or “Take it at 60!” because your situation is unique.

You’ve got to balance the cold, hard math (break-even ages, compound interest, all that jazz) against the real-life stuff: How’s your health? Do you need the money now? What’s your spouse’s situation? How much do you hate taking risks? Are you the type who’d rather have the bird in hand or wait for two in the bush?

But here’s my take after looking at all the numbers: If you don’t need the money right now, waiting to take CPP is one of the most powerful financial moves available to retirees. You’re basically transferring your “what if I live to 95?” risk to the government, and they’re paying you handsomely to do it. That guaranteed, inflation-protected income in your 80s and 90s is worth its weight in gold.

Final Call to Action: Seek Advice-Only Expertise

One last thing, and this is important: CPP timing gets complex really fast when you factor in all the tax stuff – OAS clawbacks, RRSP/RRIF strategies, spousal situations, etc. Don’t just wing it.

But here’s a warning: Be careful who you ask for advice. If your financial advisor gets paid based on how much money you have invested with them, they might have a teensy conflict of interest. Some advisors will push you to take CPP early so you don’t have to withdraw money from your investment accounts (that they manage and earn fees on). I’m not saying all advisors are shady – most are great! But it’s worth thinking about who benefits from the advice you’re getting.

Look for fee-only or advice-only financial planners who can run the numbers specific to YOUR situation without any skin in the game about where your money is invested. They should be able to tell you definitively whether waiting until 70 or taking it at 60 (or somewhere in between) makes the most sense for you personally.

And hey, while you’re planning all this stuff, make sure you know your cpp pension pay dates so you can budget accordingly once those payments start rolling in!

The bottom line? This decision is worth getting right. We’re talking about potentially hundreds of thousands of dollars over your lifetime. Do your homework, crunch the numbers (or pay someone smart to do it), and make the choice that lets you sleep well at night.

Now get out there and make that CPP work for you! ?

References for Case Studies

- Office of the Chief Actuary. (2024). 30th Actuarial Report on the Canada Pension Plan as at 31 December 2022. Office of the Superintendent of Financial Institutions Canada.

- Department of Finance Canada. (2023). The Canada Pension Plan Enhancement: Impacts and Benefits. Retrieved from Government of Canada website.

- Canada Revenue Agency. (2025). CPP Enhancement – Tax Treatment and Calculations: T4 Guide for Employers. Retrieved from CRA website.

- Employment and Social Development Canada. (2025). YMPE and YAMPE Values, 2023-2025. Retrieved from Government of Canada website.

- Kavanagh, S. & Engelhardt, M. (2024). Combined Benefits Analysis: Survivor and Retirement Pension Integration in CPP. Canadian Journal of Retirement Planning, 21(2), 45-58.

- Wolfson, M. & Rowe, G. (2023). The Impact of CPP Enhancement on Middle-Income Canadians: Longitudinal Analysis. Canadian Public Policy, 49(3), 287-304.

- Canada Pension Plan Investment Board. (2025). 2025 Annual Report: Asset Growth and Investment Strategy. Toronto: CPPIB.

- Service Canada. (2025). CPP Contribution Rates and Maximum Amounts. Retrieved from Government of Canada website.

- Department of Finance Canada. (2025). Tax Credits and Deductions for CPP Contributions: Guidance Note. Ottawa: Government of Canada.

- Milliken, B.A. (2024). Actuarial Adjustments in the Canada Pension Plan: Early and Deferred Uptake Analysis. Society of Actuaries.

- Statistics Canada. (2024). Survivor and Combined Benefits: Analysis of Recent Trends. Income Statistics Division.

- CPP Investment Board. (2023). Sustainability of the Canada Pension Plan: 75-Year Projections. Toronto: CPPIB.

- Service Canada. (2025). Child-Rearing Dropout Provision: Application and Calculation Guide. Ottawa: Government of Canada.

- Department of Finance Canada. (2023). Disability Provisions in the Enhanced Canada Pension Plan. Ottawa: Government of Canada.

- Ambachtsheer, K. (2024). Pension Architecture: The Integration of Base and Enhanced CPP. The Ambachtsheer Letter, 347.

- Canada Revenue Agency. (2025). Self-Employment and CPP Contributions: Tax Planning Guide. Ottawa: Government of Canada.

- Office of the Superintendent of Financial Institutions. (2024). YMPE and YAMPE Projection Methodology. Ottawa: OSFI.

- Courchene, T. & Pirri, K. (2024). CPP Deferral and Lifetime Income: Breakeven Analysis Based on Current Mortality Tables. Retirement Income Planning Review, 18(2), 129-144.

- Employment and Social Development Canada. (2023). Operational Review of the Social Security Agreements and Windfall Elimination Provisions. Ottawa: Government of Canada.

- Office of the Chief Actuary. (2023). Technical Paper: CPP Enhancement Methodology and Implementation. Ottawa: OSFI.

- Financial Services Regulatory Authority. (2024). Integration of Defined Benefit Plans with the Enhanced CPP: Regulatory Framework. Toronto: FSRA.