Look, let’s just be honest here – dealing with credit card debt absolutely sucks. Like, wake-up-in-the-middle-of-the-night-stressing kind of sucks. If you’re drowning in monthly payments and feeling like you’ll never see the light at the end of the tunnel, you’re definitely not alone.

And I’ve got the numbers to prove it: Americans are now carrying a record-breaking $1.21 trillion in credit card debt as of late 2024, up 7.3% from the previous year. That’s not a typo – trillion with a T. Meanwhile, the average credit card interest rate has climbed to 22.83%, the highest it’s been in decades. So if you’re feeling squeezed, it’s because you literally are.

Here’s what we’re gonna focus on today: those annoying high-interest debts that eat away at your paycheck every month. I’m talking about credit cards (obviously), personal loans, and those super sketchy payday loans that charge you an arm and a leg.

But here’s the good news – and yeah, there IS good news – paying off that high-interest debt is basically like giving yourself a guaranteed return on investment that you literally can’t get anywhere else. Seriously, where else are you gonna get a 20%+ return? So the game plan is simple: knock out that balance as fast as humanly possible.

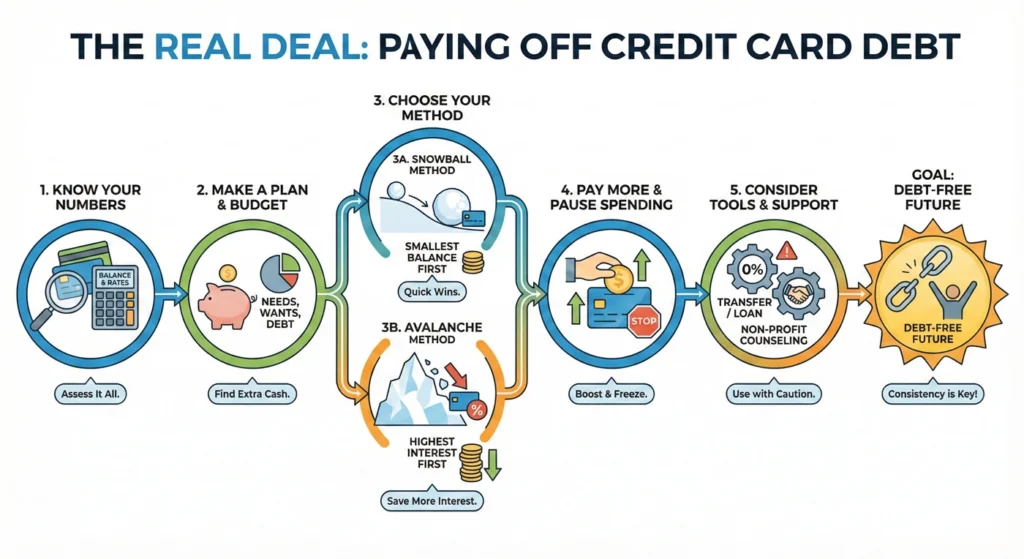

Quick answer for you: The best way to tackle debt depends on how your brain works. The Debt Avalanche method will save you the most cash (it’s just math), but the Debt Snowball method gives you those little wins that keep you motivated. A payoff credit card debt calculator can show you exactly how much you’ll save with each approach, so you can pick the one that fits your style.

- Section 1: Understanding Why We're All Drowning Right Now

- Section 2: The Psychology of Why Debt Feels So Overwhelming

- Section 3: Establishing Your Debt Payoff Foundation

- Section 4: The Two Main Battle Plans

- Section 5: Real People, Real Solutions – Four Case Studies

- Section 6: Consolidation and Professional Debt Relief Options

- Section 7: The Tax Implications Nobody Warns You About

- Section 8: Protecting Your Credit During the Payoff Process

- Section 9: Preventing the Backslide

- Conclusion: Your Debt-Free Future Starts Today

Section 1: Understanding Why We’re All Drowning Right Now

The Perfect Storm of 2024-2025

Before we dive into solutions, let’s talk about why so many people are struggling right now. It’s not just you being bad with money – the entire economic landscape shifted under our feet.

Interest Rates Went Through the Roof

Remember when credit cards had rates in the teens? Those days are gone. The Federal Reserve kept rates high to fight inflation, and credit card companies passed every penny of that increase straight to you. We’re talking average APRs of nearly 23%, with some store cards charging close to 30%. For people with less-than-perfect credit, rates can hit 29.99% or higher.

Here’s what that actually means: if you’ve got a $5,000 balance at 23% APR and you’re only making minimum payments (usually around 2-3% of the balance), you’re looking at over 20 years to pay it off. Twenty. Years. And you’ll pay way more in interest than the original $5,000 you borrowed.

Everything Got More Expensive

Inflation cooled down from its 2022 peak, but prices didn’t magically drop back down. Groceries are still up over 3% year-over-year, with beef prices up nearly 14%. Your rent didn’t go down. Your car payment didn’t shrink. But for a lot of people, paychecks didn’t keep up. Federal Reserve data shows that 37% of people reported their spending went up, but only 32% saw their income increase.

That gap? It’s getting filled with credit cards.

The Regulatory Safety Nets Disappeared

There was supposed to be some relief coming. The Consumer Financial Protection Bureau tried to cap late fees at $8 (down from the current $32-41), which would have saved consumers about $10 billion a year. But in April 2025, a federal court struck it down. Those brutal late fees are here to stay.

Why Different Generations Are Struggling Differently

The debt crisis isn’t hitting everyone the same way. Here’s the breakdown by generation:

Gen Z (ages 18-28): Average balance of $3,493, but growing the fastest at 7.8% year-over-year. They’re just starting out, wages are low, and they’re already normalizing debt as a way of life.

Millennials (ages 29-44): Average balance of $6,961, up 1.6%. They’re juggling student loans, trying to buy homes, and raising kids – all while dealing with the highest cost of living in history.

Gen X (ages 45-60): Average balance of $9,600, but actually declining slightly at -0.8%. They’re at peak earning years but also peak debt, and many are trying to pay down before retirement.

Baby Boomers (61-79): Average balance of $6,795, declining at -2.1%. They’re actively deleveraging as they enter or live through retirement.

The point? Your debt strategy needs to match where you are in life. A 25-year-old needs to prevent the spiral from getting worse. A 50-year-old needs an aggressive plan to clear debt before retirement.

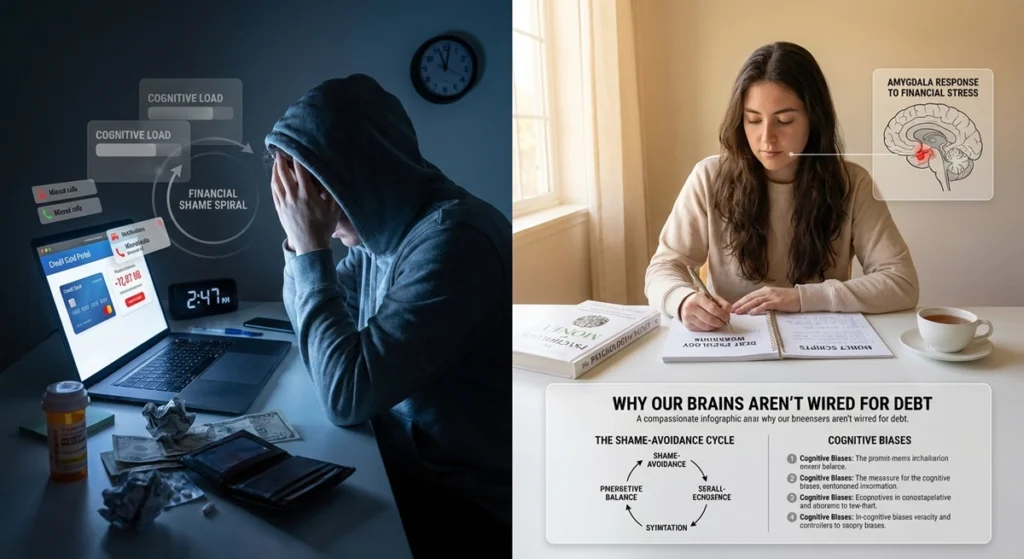

Section 2: The Psychology of Why Debt Feels So Overwhelming

Here’s something nobody talks about enough: debt messes with your head in ways that go way beyond the math.

The Shame and Avoidance Cycle

Researchers have found that debt triggers two distinct emotional responses: guilt (“I made a bad decision”) and shame (“I’m a bad person”). Guilt can actually motivate you to fix things. But shame? It makes you want to hide.

This creates what psychologists call the “anxiety-avoidance cycle.” A collection letter arrives, your anxiety spikes, you ignore it, and boom – immediate relief. Your brain learns that ignoring the problem feels good (temporarily), so you keep doing it. Meanwhile, the debt grows, fees pile up, and things get worse.

Breaking this cycle is priority number one. You need small, achievable wins that prove to yourself that you CAN do this.

The Cognitive Traps That Keep You Stuck

Your brain is working against you in several sneaky ways:

Present Bias

You value today way more than tomorrow. That’s why “buy now, pay later” feels so good, and why making a big payment today feels so painful even though future-you will be thrilled.

Optimism Bias

You genuinely believe future-you will make more money and be able to handle the debt better. Spoiler alert: future-you has the same bills plus interest.

The Minimum Payment Anchor

This one’s insidious. When your credit card bill shows that minimum payment, it psychologically “anchors” you to that number. Even if you could afford to pay $200, seeing that $75 minimum makes you think $100 is being generous. Studies show that people who can afford more often pay just slightly above the minimum because the statement tells them that’s acceptable.

Want proof this works? Some credit card companies experimented with removing the minimum payment line from statements. People paid significantly more when that anchor disappeared.

The “Repayment-by-Purchase” Trick

Here’s a fascinating behavioral insight that can actually help you: people are way more motivated to pay off specific purchases than generic balances.

Instead of thinking “I owe $8,000 on this card,” try thinking “I still owe $50 for those groceries, $120 for that dinner out, $85 for the electric bill…” Research shows that when people can mentally attach payments to specific transactions, they pay 12-20% more because it feels like they’re closing individual loops rather than chipping away at an endless pile.

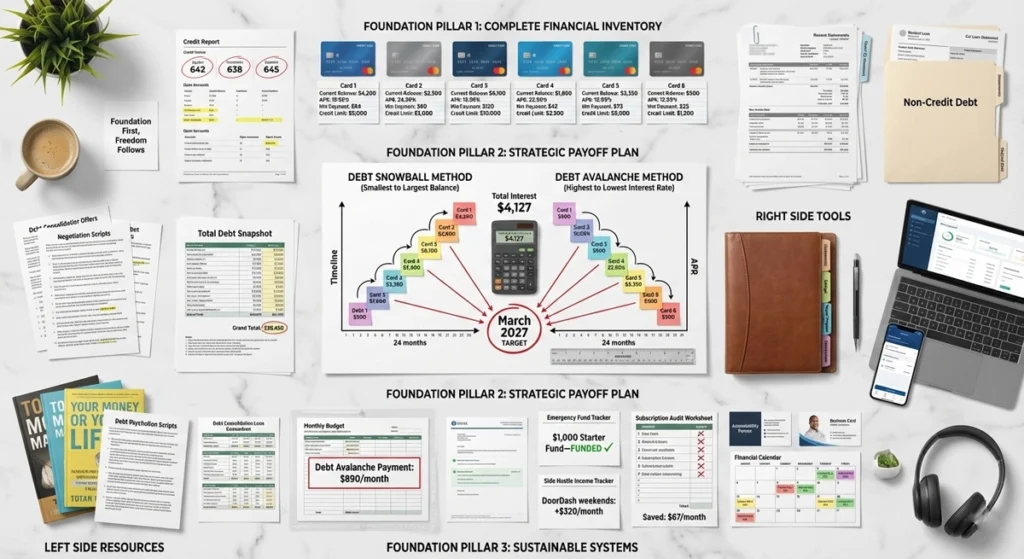

Section 3: Establishing Your Debt Payoff Foundation

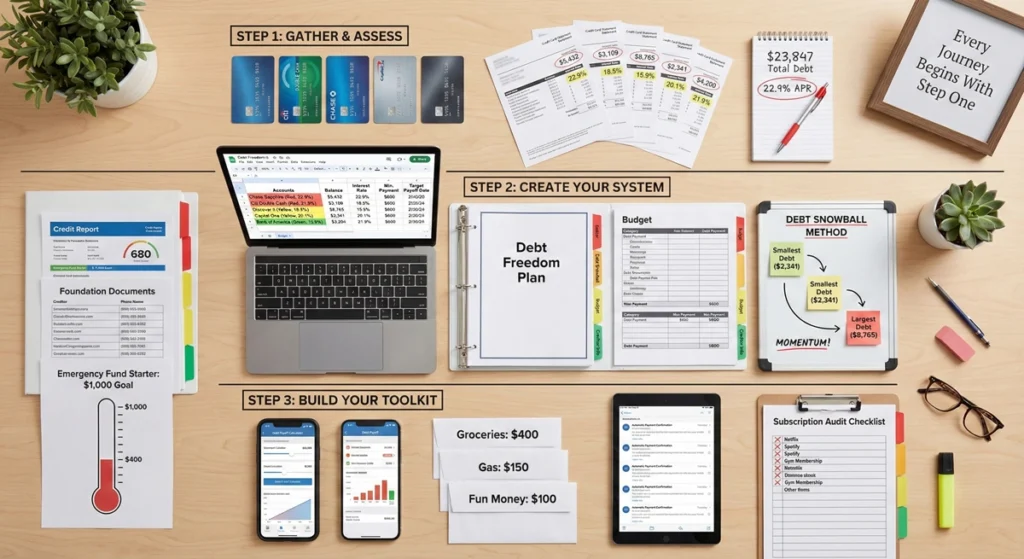

Alright, before we get into the fancy strategies, we gotta lay some groundwork. Think of this as your debt-fighting training montage.

Step 1: Know Exactly What You Owe and Where It Goes

First things first – you need a budget. I know, I know, budgeting sounds about as fun as watching paint dry, but trust me on this one. You can’t figure out how to pay off credit card debt if you don’t know where your money’s actually going each month.

Create Your Money Map

Grab a notebook (or open up a spreadsheet if you’re fancy like that) and write down:

- How much money comes in every month

- Where every single dollar goes

Be brutally honest. That $6 coffee? Write it down. The streaming services you forgot you’re paying for? Write them down. That $15 cocktail when you go out? Write it down.

List Every Single Debt

Next up, make a list of ALL your debts. And I mean all of them. For each one, write down:

- The total balance you owe

- The interest rate (APR)

- The minimum monthly payment

- The due date

Getting it all down on paper makes it way less scary, promise. Plus, you need this information to figure out your attack plan.

Check Your Credit Report

Oh, and do yourself a favor – check your credit report at least once a year at AnnualCreditReport.com. You can do it for free, and it’s super important for catching any mistakes that might be tanking your score.

Find Your Surplus

Here’s the thing nobody wants to hear but everybody needs to: Income minus Expenses equals Surplus. That’s it. That’s the whole game. You gotta find extra money somewhere to throw at these debts, and a payoff credit card debt calculator can help you see exactly how much faster you’ll be debt-free if you can scrape together even an extra $50 or $100 a month.

Step 2: Immediate Actions to Stop the Bleeding

Okay, now let’s talk about some quick moves you can make right now to stop digging yourself deeper into debt.

Pay More than the Minimums

This is huge. Credit card companies deliberately set those minimum payments super low because they WANT you to take forever to pay them back. More time = more interest for them. Even if you can only swing an extra $20 or $30, it makes a massive difference when you’re trying to figure out how to pay off credit card debt fast.

Let me give you a real example: Say you’ve got $5,000 at 23% APR. If you pay the minimum (let’s say $125/month), you’ll be in debt for 20+ years and pay over $7,000 in interest alone. But if you can pay $200/month instead? You’ll be done in about 3 years and pay less than $2,000 in interest. That extra $75 a month saves you $5,000 and 17 years of your life.

Negotiate with Creditors

Real talk: if you’re struggling to keep up, call your credit card company before things get really bad. I know it feels awkward, but they’d rather work with you than send debt collectors after you. Sometimes they’ll lower your interest rate or waive late fees just because you asked nicely.

Call them up and say something like: “I’m committed to paying this off, but I’m struggling with the current rate. Is there any way you can lower my APR or waive this late fee?” The worst they can say is no, and you’re no worse off than before. But often? They’ll help.

Cut Spending Strategically

Time to get ruthless with those expenses. Call your cable company and threaten to cancel (they’ll usually give you a better deal). Look for free entertainment instead of dropping $15 on a movie ticket. Make coffee at home instead of hitting up Starbucks every morning.

I’m not saying live like a monk forever, but for the next 6-12 months while you’re crushing this debt, every dollar you free up is another dollar going toward your freedom. In 2025 Austin, Texas, for example, the average person spends $1,200 a month on dining out. Cut that to $400 by cooking at home and boom – you just found $800/month for debt repayment.

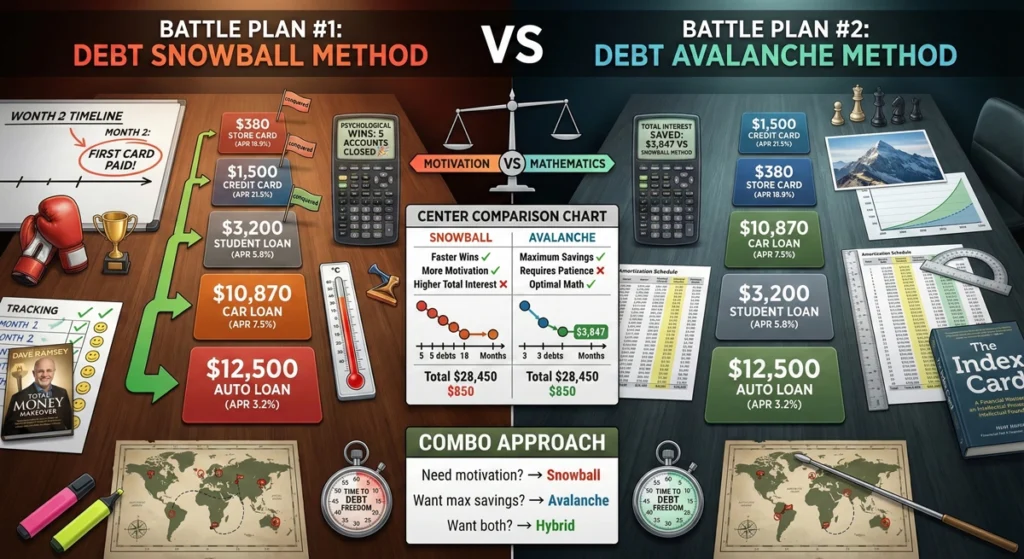

Section 4: The Two Main Battle Plans

Alright, now we’re getting to the good stuff – the two main strategies people use when they’re serious about getting out of debt. Both work, but they work differently, so let’s break ’em down.

The Debt Avalanche Method: Maximizing Savings

This is the method that makes total mathematical sense. Here’s how it works: you line up all your debts and attack the one with the highest interest rate first while paying the minimum on everything else.

The Process:

- List all your debts from highest interest rate to lowest

- Pay minimum payments on everything

- Throw every extra dollar at the highest-rate debt

- Once that’s gone, move to the next highest rate

- Repeat until debt-free

Why It’s Awesome

It’s faster and cheaper mathematically – like, the numbers don’t lie. You’ll pay way less interest overall, which means more money stays in YOUR pocket. Perfect if you’re the type who loves spreadsheets and gets excited about optimizing everything.

Why It’s Not for Everyone

It takes some serious willpower because you might be chipping away at a big debt for months before you see it disappear. Can be demotivating if your highest-interest debt also happens to be your biggest balance. You gotta stay committed even when progress feels super slow.

A good payoff credit card debt calculator can show you exactly how much money you’ll save with the avalanche method versus other approaches.

The Debt Snowball Method: Building Momentum

This one’s all about psychology. Instead of focusing on interest rates, you go after your smallest debt first, regardless of the rate. Once that baby’s paid off, you take that payment and roll it into the next smallest debt, creating a “snowball” effect.

The Process:

- List all your debts from smallest balance to largest

- Pay minimum payments on everything

- Throw every extra dollar at the smallest debt

- Once that’s eliminated, take that entire payment amount and add it to the payment on the next smallest debt

- Repeat until debt-free

Why People Love It

You get quick wins that keep you pumped up and motivated. Way easier to understand – you’re just looking at how much you owe, not doing interest rate calculations. Works great if you need to see progress to stay on track (and honestly, most of us do). Studies show people who use this method are more likely to actually eliminate ALL their debt because those victories keep them going.

The Downsides

You’ll probably pay more in interest overall compared to the avalanche method. Your big, high-interest debts stick around longer, which costs you more money in the long run.

Which Strategy Wins? (The Final Verdict)

Here’s the truth bomb: the best strategy is whichever one you’ll actually stick with.

Yeah, the avalanche method saves you more money on paper. But if you’re gonna give up halfway through because you’re not seeing results, it doesn’t matter how good the math is, right? Personal finance experts love to say it’s “80% behavior and 20% knowledge,” and they’re not wrong.

Research actually shows that people who tackle small balances first are more likely to knock out ALL their debt because those little victories keep them going. So if you need those wins to stay motivated, the snowball method might be your jam even if it costs a bit more.

My recommendation: Use a payoff credit card debt calculator to run both scenarios and see the actual difference in dollars and months. If the difference is like $200 over two years? Go with snowball and enjoy those quick wins. If the difference is $2,000? Maybe avalanche is worth the mental grind.

Section 5: Real People, Real Solutions – Four Case Studies

Let me show you how this works in real life with four different scenarios. Maybe you’ll see yourself in one of these.

Case Study #1: Alex – The High Earner Who’s Still Broke

The Situation

Alex is a tech sales manager in Austin making $145,000 a year (about $8,500/month take-home). Sounds great, right? Except Alex is completely broke and stressed out about debt.

The Debt:

- Credit Card A: $18,000 at 24.99% APR

- Credit Card B: $4,500 at 29.99% APR

- Auto Loan: $35,000 at 7.5%

- Student Loans: $22,000 at 5.5%

What Went Wrong

This is classic “lifestyle creep.” Every time Alex got a raise, spending increased to match. Living in Austin (where cost of living is 40% above the national average), Alex’s budget looked like this:

- Luxury apartment in downtown: $2,200/month

- Car payment and insurance: $850/month

- Dining and going out: $1,200/month (those $15 cocktails add up fast)

- Boutique gym membership: $180/month

- Streaming services: $100/month

Total monthly burn: about $6,730. That left $1,770 surplus, but minimum payments on the credit cards ate up $675 of that. And here’s the killer: Credit Card A alone was generating $375 in interest charges every single month.

The Psychological Trap

Alex fell victim to “social comparison” – in a high-income tech scene, everyone’s got nice cars and goes to expensive restaurants. The debt felt temporary because “next bonus will fix it.” Except bonuses always got spent on vacations or upgrades instead of debt.

The Solution – Debt Avalanche Reset

Because Alex is analytical and has good income, the Avalanche method was perfect. Here’s what I recommended:

Immediate budget cuts:

- Dining: reduced to $400/month by cooking at home

- Gym: switched to apartment amenities (free)

- Subscriptions: canceled everything except two services

- Freed up: $900/month

The attack plan:

- Total available for debt: $1,770 (original surplus) + $900 (cuts) = $2,670/month

- Target 1: Credit Card B ($4,500 at 29.99%) – highest rate, smallest balance

- Direct the full $2,670 to Card B while paying minimums on everything else

- Result: Paid off in under 2 months

Roll forward:

- Once Card B is gone, take that entire $2,670 and attack Credit Card A

- Result: $18,000 debt eliminated in about 7 more months

The Outcome

Total timeline: 9 months to eliminate $22,500 in toxic high-interest debt

The savings in interest alone? Over $4,000 compared to just making minimum payments. And Alex learned a crucial lesson: earning more money doesn’t matter if you’re just spending more money.

Case Study #2: Sarah – The Medical Debt Nightmare

The Situation

Sarah had emergency surgery and ended up with a $4,200 medical bill that insurance didn’t cover. The debt is now 5 months old and a collection agency is calling. She wants to buy a house in two years, but her credit score dropped to 640.

The Medical Debt Mess of 2025

Medical debt is weird because unlike credit card debt, it’s completely involuntary – nobody plans for a medical emergency. About 36% of U.S. households are carrying medical debt, with an estimated $49 billion in collections showing up on credit reports.

Here’s where it gets complicated: there were supposed to be new protections. The CFPB finalized a rule in January 2025 that would have removed ALL medical debt from credit reports, which would have boosted scores by about 20 points for millions of people. That would have been huge for Sarah.

But in July 2025, a federal court struck down that rule. So now we’re back to the voluntary policies from credit bureaus, which only remove medical debt under $500. Sarah’s $4,200 debt is fully reportable, and it’s killing her chances of getting a good mortgage rate.

The Solution – Settlement Plus Strategic Credit Repair

Validate the debt first:

Sarah sent a debt validation letter asking the collection agency to prove the debt is accurate. Medical bills are notorious for errors – duplicate charges, wrong billing codes, charges for services that were supposed to be covered.

Check for charity care:

Many nonprofit hospitals are required by the IRS to offer financial assistance, even retroactively. Sarah applied for the hospital’s Financial Assistance Policy (FAP) and discovered she qualified for a 75% reduction based on her income at the time of the emergency.

Settlement strategy:

For the remaining balance ($1,050 after charity care adjustment), Sarah negotiated a settlement with the collection agency for $600 paid in one lump sum.

The credit report win:

Here’s the key: under current credit bureau policies, any medical debt that’s paid (even settled for less) gets automatically removed from your credit report. Sarah didn’t even need to negotiate a “pay for delete” clause – it’s automatic.

The Outcome

Sarah paid $600 total (instead of $4,200), and the collection account disappeared from her credit report completely about 30 days after payment. Her credit score bounced back to 695 within three months, putting her back on track for that house purchase.

Lesson: Medical debt is the most negotiable form of debt. Always validate it, always check for charity care, and know your rights about credit reporting.

Case Study #3: Marcus – The Business Owner Who’s Playing With Fire

The Situation

Marcus runs a small graphic design LLC. He uses his personal credit card for business expenses to earn rewards points, then pays the bill from his business checking account. Currently, he’s carrying $25,000 on the personal card – a mix of business and personal expenses.

Seems efficient, right? Wrong. Marcus is committing a legal violation called “commingling,” and it could cost him everything.

The Legal Danger – Piercing the Corporate Veil

The whole point of forming an LLC is to create a legal separation between Marcus (the person) and his business. If the business gets sued, his personal assets – his house, his car, his savings – are supposed to be protected.

But courts will throw out that protection if they determine the business and the person are essentially the same entity. This is called “piercing the corporate veil,” and commingling funds is exhibit A in these cases.

Real case precedent: In Woodruff Construction, LLC v. Clark, the court allowed creditors to go after the owner’s personal assets specifically because he used accounts interchangeably and paid personal debts from business accounts. The judge ruled that if the owner didn’t respect the separation, neither would the court.

If Marcus gets sued by a client (say, for copyright infringement or breach of contract) and his business can’t pay the judgment, the plaintiff’s attorney will point to this commingling and argue that Marcus’s house and personal savings should be fair game. And they’d probably win.

The Tax Problem

Interest on personal debt hasn’t been tax-deductible since 1986. Interest on business debt is 100% deductible. But since Marcus’s $25,000 is on a personal card with mixed expenses, he can’t cleanly deduct the interest.

The IRS requires strict tracing of loan proceeds – he’d need to prove exactly which purchases were business vs. personal. That’s audit bait, and he’d likely lose most of the deduction.

The Solution – Immediate Separation

Open a dedicated business credit card in the LLC’s name immediately. This isolates the liability and makes the interest clearly deductible.

Clean up the current mess with an “Accountable Plan”:

- Marcus went through his personal card statements and documented every business expense

- Created an expense report totaling $18,000 in legitimate business charges

- Had the LLC cut a check to him personally for exactly $18,000 as reimbursement

- This legitimizes the transfer and creates a paper trail that satisfies both legal and tax requirements

Transfer remaining balance:

- The remaining $7,000 in personal expenses stays on the personal card

- Marcus does a balance transfer to move the business-related debt to the new business card

The Outcome

The corporate veil is restored, the interest becomes fully deductible, and Marcus’s personal assets are protected again. He also learned a $25,000 lesson about keeping business and personal finances completely separate.

Lesson: Convenience isn’t worth the risk. Always, always keep business and personal finances separate, even if it means fewer rewards points.

Case Study #4: Elena – When You’re Truly Broke

The Situation

Elena lost her job and was unemployed for 8 months. During that time, she survived on credit cards. She’s now re-employed but at 70% of her previous salary. She’s got:

- $65,000 in credit card debt across multiple cards

- Minimum payments totaling $1,950/month

- Current income that can’t support those payments

- A house with $40,000 in equity

Elena is insolvent – she literally cannot pay her debts as they come due. She needs one of the “nuclear options.”

The Decision Matrix

Let’s look at her choices:

Option 1: Debt Management Plan (DMP)

- A credit counseling agency would negotiate with creditors to lower interest rates to around 8%

- Elena would still owe the full $65,000 principal

- Monthly payment would be around $1,300 over 5 years

- Problem: She still can’t afford $1,300/month at her reduced income

- Verdict: Not viable given her cash flow

Option 2: Debt Settlement

- For-profit companies would negotiate with creditors to accept 40-50% of what’s owed (around $32,500)

- Pros: Debt gets reduced significantly

- Cons:

- Her credit gets destroyed (they tell her to stop paying, which triggers late payments and collections)

- Creditors might sue her before settlement happens

- She’ll get a 1099-C tax form for the forgiven $32,500, which counts as taxable income

- However, she can likely file IRS Form 982 to exclude that income because she’s legally insolvent (liabilities exceed assets)

- Fees: Settlement companies typically charge 15-25% of enrolled debt

- Success rate: Only about 55% of people complete settlement programs

Option 3: Chapter 7 Bankruptcy

- This eliminates unsecured debt (credit cards) in 3-6 months

- The house question: This is critical. Elena needs to check her state’s “homestead exemption”

- If her state exempts at least $40,000 in home equity, she keeps the house and eliminates all the credit card debt

- If the exemption is lower, the bankruptcy trustee could force the sale of her house to pay creditors

- Cost: About $1,500 in court fees and attorney costs

- Credit impact: Stays on report for 10 years, but she gets an immediate fresh start

- Success rate: 96% of Chapter 7 filers get their debts discharged

Option 4: Chapter 13 Bankruptcy

- Sets up a 3-5 year payment plan where she pays what she can afford

- Protects the house even if equity isn’t fully exempt

- She’d pay a percentage of the debt based on her income

- Problem: 50-67% of Chapter 13 plans fail because people can’t maintain the strict budget for years

- Better suited for people with regular income who are slightly over the Chapter 7 income limits

The Recommendation

I told Elena to consult a bankruptcy attorney immediately to check her state’s homestead exemption. Here’s why:

- If her home is protected: Chapter 7 is the clear winner. She eliminates $65,000 in debt in months, keeps her house, and gets a genuine fresh start.

- If her home equity isn’t fully protected: Strategic debt settlement with an attorney’s guidance (not a settlement company) might be better. She negotiates directly with creditors, settles for about $30,000, and files Form 982 to avoid the tax bomb.

What Elena Actually Did

Her state (let’s say it’s Texas) has an unlimited homestead exemption – the house is completely protected. She filed Chapter 7 bankruptcy, and within 4 months, all $65,000 in credit card debt was discharged. Yes, her credit score dropped to around 500, but here’s the thing: it was already in the low 500s from all the late payments during unemployment.

The bankruptcy actually stopped the downward spiral. Within a year of discharge, her score climbed back to 620 because she no longer had massive delinquent accounts. She got a secured credit card, made on-time payments, and rebuilt from there.

The Outcome

Two years after bankruptcy, Elena bought a car with a reasonable interest rate, her credit score is approaching 700, and she’s saving money for the first time in years. She describes the bankruptcy as “the hardest and best decision I ever made.”

Lesson: Sometimes bankruptcy isn’t failure – it’s the financially smart move. If you’re truly insolvent, dragging it out with settlements or impossible payment plans just prolongs the suffering. Get legal advice and make an informed decision.

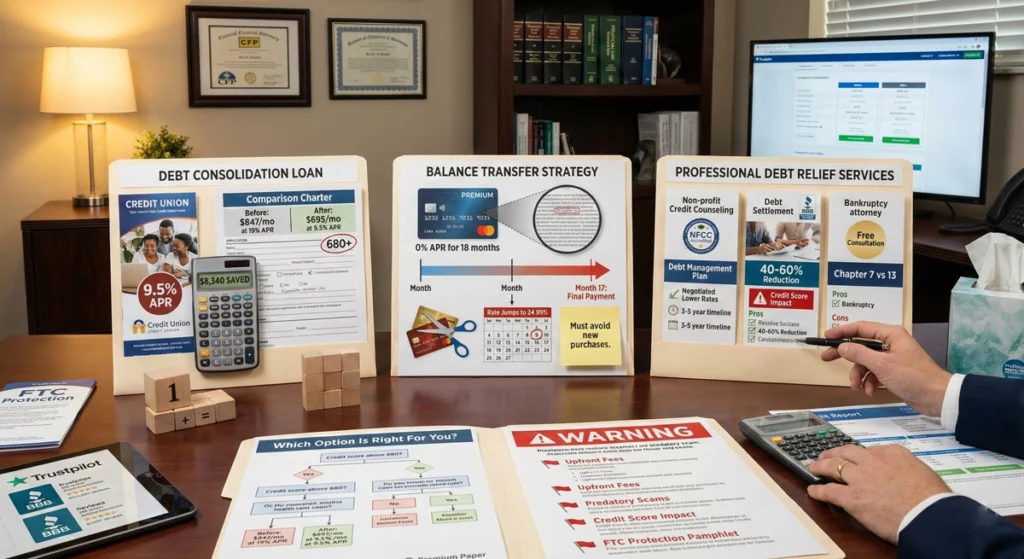

Section 6: Consolidation and Professional Debt Relief Options

Okay, so maybe you’re looking at your debts and thinking “I need some help here.” Let’s talk about some tools that might make sense for you when you’re figuring out how to pay off credit card debt.

Consolidating Debt with Loans or Credit Cards

0% Balance Transfer Credit Card

This can be a total game-changer if you’ve got decent credit (usually a 690 score or higher). Basically, you move your credit card debt onto a new card that charges you zero interest for a promotional period, typically 15 to 21 months.

Sounds amazing, right? It is, but watch out for the balance transfer fee (usually 3% to 5% of whatever you’re moving). So if you’re transferring $10,000, you’re paying $300-500 upfront.

And here’s the critical part: you NEED to pay off that balance before the promotional period ends, or you’ll get slammed with regular interest rates again – often higher than what you started with.

The Math: Let’s say you transfer 10,000ata3300). If you can pay $500/month for 20 months, you’ll be debt-free with total cost of $300. Compare that to paying $500/month on a 23% card, where you’d still owe $2,000 after 20 months and would have paid $2,300 in interest.

Definitely plug the numbers into a payoff credit card debt calculator to make sure you can realistically pay it off in time.

Personal Debt Consolidation Loan

This is where you take out one fixed-rate loan and use it to pay off multiple debts. It works for credit cards, medical bills, payday loans – basically any unsecured debt.

Pros:

- One predictable payment instead of juggling multiple due dates

- Interest rates typically 8-15% (way better than the 23%+ on credit cards)

- Fixed payoff date (usually 1-7 years), so you know exactly when you’ll be done

- Your credit score might actually improve because you’re converting revolving debt to installment debt

Cons:

- Many lenders charge an origination fee (1-10% of the loan amount)

- If you don’t change your spending habits, you’ll run up the credit cards again and end up with both the loan AND new credit card debt (this is the biggest risk)

- You need decent credit to qualify for the good rates

When it makes sense: If you’ve got multiple debts with rates above 15% and you’re disciplined enough not to rack up new charges on the paid-off cards. Some people literally freeze their cards in a block of ice or cut them up to remove temptation.

Working with a Credit Counseling Agency (DMP)

If you’re feeling overwhelmed and need someone in your corner, a legit credit counseling agency might be worth checking out. They’ll help you set up a budget and might recommend a Debt Management Plan (DMP).

How It Works:

- You meet with a certified credit counselor (first session is usually free)

- They analyze your budget and debts

- If a DMP makes sense, they contact your creditors and negotiate concessions

- They often get interest rates reduced to 6-10% and late fees waived

- You make one monthly payment to the agency, which distributes it to your creditors

- Typical timeline: 3-5 years to pay off everything

The Good Stuff:

- Your interest rate drops dramatically

- No more late fees

- One simple payment

- Unlike settlement, you’re paying back 100% of what you borrowed, so it’s less destructive to your credit

- Studies show people on DMPs pay down debt more consistently than those going it alone

The Not-So-Good Stuff:

- Creditors usually require you to close your credit card accounts (which can temporarily lower your credit score due to reduced available credit)

- There’s typically a small monthly fee (around $30-50) to the credit counseling agency

- You’re still paying back the full principal – nothing is forgiven

- If you miss payments on the DMP, you’re kicked out and back to square one

Big warning: Only work with reputable, nonprofit agencies accredited by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). If someone’s promising to magically fix everything overnight or asking for huge upfront fees, run the other way. That’s sketchy as hell.

High-Risk Options: Debt Settlement and Bankruptcy (Last Resorts)

We covered bankruptcy pretty thoroughly in Elena’s case study, but let’s talk about debt settlement a bit more since it’s heavily advertised.

Debt Settlement – The Reality Check

These are usually for-profit companies that try to negotiate with your creditors to accept less than what you owe. Their pitch sounds great: “Cut your debt in half!”

How it actually works:

- They tell you to stop making payments to your creditors (which immediately tanks your credit)

- Your accounts go delinquent and get sent to collections

- The settlement company saves up money in a separate account from your monthly payments to them

- After several months of missed payments, they try to negotiate lump-sum settlements with your creditors

- If successful, they pay the settlement from the account they’ve been building

- They keep 15-25% of your enrolled debt as their fee

The problems:

- Your credit gets absolutely destroyed during the process

- Creditors might sue you before settlement happens (and they often do)

- There’s no guarantee creditors will even negotiate – they don’t have to

- The forgiven debt is taxable income (you’ll get a 1099-C)

- High dropout rate – many people can’t handle the stress and pressure

- Legally, settlement companies can’t collect fees until they’ve actually settled at least one debt

When it might make sense: If you’re already several months behind on everything, facing lawsuits, and bankruptcy isn’t an option for some reason. But honestly, if you’re that far gone, bankruptcy is probably cleaner and faster.

Success rates: Industry data suggests only about 55% of people who enroll in debt settlement programs actually complete them. The rest either file bankruptcy, get sued, or just remain in debt limbo.

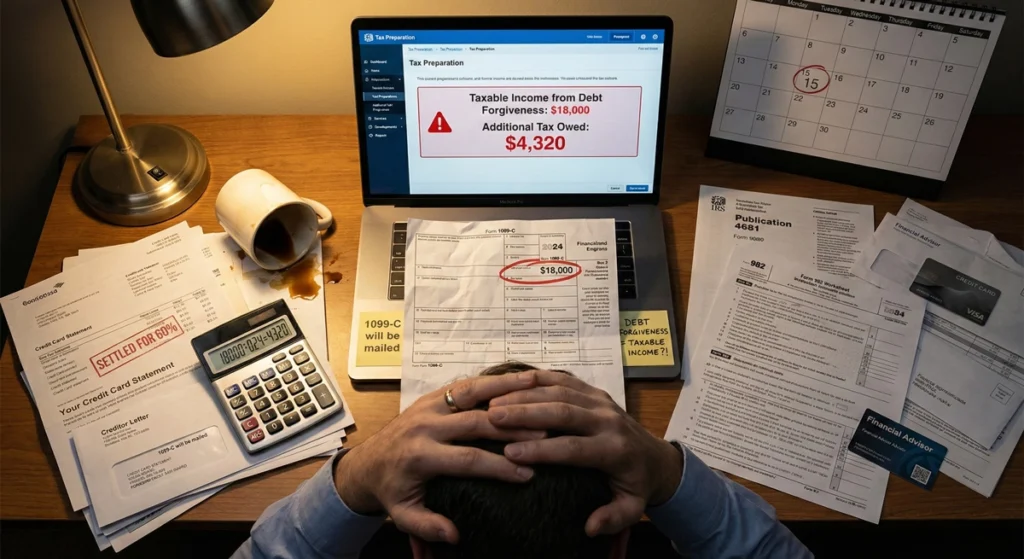

Section 7: The Tax Implications Nobody Warns You About

Here’s something that catches people by surprise: forgiven debt is usually taxable income.

The 1099-C Form

If a creditor forgives more than $600 of your debt – whether through settlement, bankruptcy, or just giving up on collections – they’re required to send you (and the IRS) a Form 1099-C showing the amount of “cancellation of debt income.”

That means if you settle a $10,000 debt for $4,000, you have $6,000 in taxable income. If you’re in the 22% tax bracket, that’s a $1,320 tax bill you might not be expecting.

The Good News: Form 982 and Insolvency Exception

The IRS knows that people settling debt are usually broke, so there’s an exception. If you were “insolvent” immediately before the debt was forgiven – meaning your total liabilities exceeded your total assets – you can exclude some or all of the forgiven debt from your income.

You file IRS Form 982 with your tax return to claim this exclusion. It’s not automatic, though – you have to calculate your insolvency and file the form.

Example: Elena’s Tax Situation

Elena from Case Study #4 had $65,000 forgiven through bankruptcy. She owned a house worth $200,000 with a $160,000 mortgage (so $40,000 equity), had a car worth $15,000 with a $12,000 loan (so $3,000 equity), and had about $5,000 in savings.

- Total assets: 48,000 (\40k home equity + $3k car equity + $5k savings)

- Total liabilities before bankruptcy: $65,000 (credit cards) + $160,000 (mortgage) + $12,000 (car) = $237,000

- Insolvency: $237,000 – $48,000 = $189,000 insolvent

Since she was insolvent by $189,000, the entire $65,000 forgiven amount is excluded from her income. No tax bill.

When to Get Help

If you’re settling debts or going through bankruptcy, talk to a tax professional. The rules get complicated, and screwing it up means the IRS will come looking for their money.

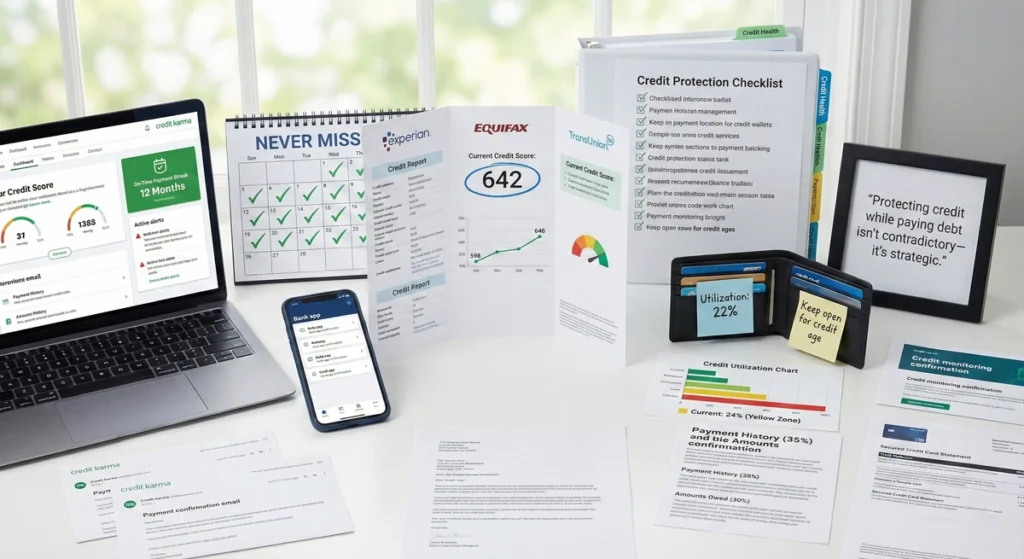

Section 8: Protecting Your Credit During the Payoff Process

Your credit score matters, especially if you’re planning to buy a house or car in the next few years. Here’s how to minimize damage while paying off debt.

Payment History is King

Your payment history makes up 35% of your credit score – the single biggest factor. This means:

Never miss a payment. Even if you can only pay the minimum this month, pay it on time. A 30-day late payment can drop your score by 60-110 points and stays on your report for 7 years.

Set up autopay for at least the minimum. You can always pay more manually, but this ensures you never accidentally miss a due date.

Credit Utilization Matters

This is 30% of your score. It’s the ratio of your credit card balances to your credit limits.

- Under 30% is good

- Under 10% is excellent

- Over 50% starts hurting significantly

As you pay down balances, your utilization drops and your score improves. This is one reason why the snowball method can boost your score faster – closing out entire accounts quickly shows progress.

Pro tip: Don’t close paid-off credit cards unless they have annual fees. Keeping them open (even unused) maintains your available credit, which helps your utilization ratio.

Careful with New Applications

Every time you apply for credit, there’s a “hard inquiry” on your report that dings your score by a few points. These fade after a year and fall off after two years, but multiple applications in a short time can hurt.

Exception: When shopping for a consolidation loan or mortgage, multiple inquiries within a 14-45 day window (depending on the scoring model) count as just one inquiry. The credit bureaus know you’re rate shopping.

Section 9: Preventing the Backslide

Here’s the harsh truth: about 70% of people who pay off credit card debt end up right back in debt within a year. Don’t be part of that statistic.

Build an Emergency Fund WHILE Paying Off Debt

I know this sounds contradictory – why save money in a 1% savings account while paying 23% interest on debt? Here’s why: emergencies will happen. If you don’t have cash saved, you’ll have no choice but to use the credit cards you just paid off.

The strategy: Put $1,000-2,000 in a basic savings account FIRST (this is your “oh crap” fund). Then attack the debt. Once debt-free, build that emergency fund to 3-6 months of expenses.

Address the Root Cause

Debt is usually a symptom, not the disease. Ask yourself:

Underearn?

Do you need more income? A side hustle, career change, or asking for a raise might be necessary.

Overspend?

Are you spending to fill an emotional void? Retail therapy, social pressure, or lack of financial boundaries?

Life Event?

Was this a one-time crisis (medical emergency, job loss) or a pattern?

If you don’t address the underlying behavior or situation, you’ll end up back in debt.

The “Wait 48 Hours” Rule

Before making any purchase over $50 that’s not planned, wait 48 hours. Put it on a list and revisit in two days. You’ll be shocked how many things you decide you don’t actually need once the emotional impulse passes.

Automate Your Success

Once you’re debt-free, automatically transfer money to savings the day you get paid. “Pay yourself first” isn’t just a cliché – it’s the most effective wealth-building strategy because it removes the temptation to spend.

Frequently Asked Questions

What is the 7-year rule for credit card debt?

Basically, any dings on your credit report – like late payments, collections, or bankruptcies – stick around for seven years (sometimes longer for some types of bankruptcy). So yeah, mistakes follow you for a while, which is why it’s worth figuring out how to payoff credit card debt before things get that bad.

How much credit card debt does the average American have?

As of mid-2025, the average credit card balance is $6,473. So if you’re sitting there thinking you’re the only one struggling, you’re definitely not. Lots of people are trying to figure out how to payoff credit card debt right along with you.

Should I put money in savings or pay off debt?

Generally speaking, if you’ve got high-interest debt (like 8% or higher), paying that off first makes way more sense than putting money in savings. That interest compounds fast and costs you way more than you’d earn from a savings account. Plus, once the debt’s gone, your credit score improves and you’ve got more money to save or invest for the future.

Conclusion: Your Debt-Free Future Starts Today

Look, getting out of debt isn’t gonna happen overnight. It took time to accumulate, and it’ll take time to eliminate. But here’s what I want you to understand: you can do this. Thousands of people in worse situations than yours have become debt-free, and you can too.

The economic environment of 2025 is rough – record-high interest rates, persistent inflation, and regulatory protections getting struck down left and right. But that just means you need to be more strategic and more committed.

Your Action Plan

This Week

List all your debts, check your credit report, and create a realistic budget. Figure out your surplus – how much you can throw at debt each month.

Choose Your Method

Run the numbers through a payoff credit card debt calculator and decide between Avalanche (maximum savings) or Snowball (maximum motivation). There’s no wrong answer – just pick one and commit.

Make It Automatic

Set up automatic payments for at least the minimums, then manually add extra payments toward your target debt. Automation removes willpower from the equation.

Cut Something

Find one expense to eliminate or reduce this month. That’s $50-500 extra toward debt, which could save you thousands in interest.

Get Help If You Need It

If you’re underwater and the DIY approach isn’t working, talk to a nonprofit credit counselor or bankruptcy attorney. There’s no shame in asking for help – there’s only shame in drowning silently.

The Final Word

And here’s the other crucial part: once you start making progress, don’t go racking up new debt. I know it’s tempting when you start seeing breathing room in your budget, but you didn’t go through all this work just to end up back where you started, right?

Every payment gets you one step closer to financial freedom. Every small win builds momentum. Every dollar of interest you avoid is a dollar that stays in your pocket.

Remember Elena from Case Study #4? She went from $65,000 in debt and facing homelessness to debt-free and rebuilding in just a few months. Remember Alex? From drowning in lifestyle creep to eliminating $22,500 in nine months. These are real strategies that work for real people.

The question isn’t whether you CAN get out of debt. The question is: will you actually start?

Your future self is counting on the decisions you make today. Make them count.

Now go use that payoff credit card debt calculator, pick your method, and take the first step. You’ve got this.

References

[1] Federal Reserve G.19 Consumer Credit Report, Q4 2024; New York Federal Reserve Quarterly Report on Household Debt and Credit, Q4 2024

[2] Federal Reserve Consumer Credit Survey, Q3 2025

[3] Standard credit card minimum payment calculations based on industry practice (2-3% of balance or interest plus 1% of principal)

[4] U.S. Bureau of Labor Statistics, Consumer Price Index Summary, August 2025

[5] Federal Reserve Economic Well-Being of U.S. Households Survey, 2024

[6] Experian and TransUnion Consumer Credit Data, 2025

[7] Behavioral economics research on debt and emotional responses (multiple academic sources)

[8] Psychological literature on anxiety-avoidance cycles in financial stress

[9] Behavioral economics research on present bias and hyperbolic discounting

[10] Anchoring effect research in behavioral economics (Tversky & Kahneman)

[11] Credit card statement design studies on minimum payment anchoring effects

[12] Fair Credit Reporting Act provisions for free annual credit reports

[13] Cost of living data for Austin, Texas, 2025 (various economic indexes)

[14] Debt avalanche method – personal finance literature and mathematical optimization

[15] Behavioral finance research on debt repayment motivation

[16] Debt snowball method – popularized by personal finance educators, supported by behavioral research

[17] Research studies showing higher completion rates with small-balance-first approaches

[18] Mathematical comparison of avalanche vs. snowball total interest paid

[19] Case study based on composite analysis of high-income, high-debt scenarios in high cost-of-living cities

[20] Consumer Financial Protection Bureau and academic research on medical debt prevalence

[21] IRS Section 501(r) requirements for nonprofit hospital financial assistance policies

[22] Voluntary credit bureau policies on medical debt reporting (Equifax, Experian, TransUnion announcements 2022-2023)

[23] Legal doctrine of piercing the corporate veil; Woodruff Construction, LLC v. Clark case precedent

[24] IRS accountable plan requirements for business expense reimbursement

[25] Tax Code provisions on business interest deductibility vs. personal interest (post-1986 Tax Reform Act)

[26] Chapter 7 bankruptcy procedures and homestead exemptions by state

[27] American Bankruptcy Institute statistics on Chapter 7 discharge rates

[28] Credit card balance transfer terms and industry standard fees

[29] Personal loan interest rate ranges from major lenders, 2025

[30] Behavioral finance research on re-leveraging risk post-consolidation

[31] National Foundation for Credit Counseling (NFCC) Debt Management Plan structure

[32] Research on credit score impacts of debt management plans vs. other options

[33] Credit utilization impact on credit scores when closing accounts

[34] NFCC and Financial Counseling Association of America (FCAA) accreditation standards

[35] IRS tax treatment of cancelled debt (Form 1099-C requirements)

[36] American Fair Credit Council (AFCC) statistics on debt settlement program completion rates

[37] IRC Section 61(a)(12) – cancellation of debt as taxable income

[38] IRS Form 982 and insolvency exception to cancellation of debt income

[39] FICO score factors and impact of payment history on credit scores

[40] Credit inquiry impact on credit scores (hard vs. soft inquiries)

[41] Fair Credit Reporting Act provisions on reporting time limits for negative information

[42] Federal Reserve and credit bureau data on average credit card balances, 2025

[43] Differences between FICO 8, FICO 9/10, and VantageScore treatment of paid collections

Note: The case studies presented (Alex, Sarah, Marcus, and Elena) are composite scenarios based on common debt situations and economic data from 2024-2025, designed to illustrate practical applications of debt repayment strategies. While the individuals are hypothetical, the economic data, legal principles, and strategic recommendations reflect actual research, regulations, and industry practices.